CCI Edits Explained: Definition, History, NCCI Rules, and Impact on Healthcare

Quick Summary of CCI Edits

Correct Coding Initiative (CCI) edits are a foundational component of healthcare billing compliance. Developed by the Centers for Medicare & Medicaid Services (CMS), CCI edits prevent improper payments by identifying code combinations that should not be reported together. These edits directly affect how claims are submitted, adjudicated, and audited across Medicare, Medicaid, and many commercial health plans.

This guide explains what CCI edits are, how they evolved into today’s National Correct Coding Initiative (NCCI), how they impact payers and providers, and how organizations can stay compliant as coding rules continue to change.

What are CCI Edits

CCI Edits History

The Correct Coding Initiative (CCI) was adopted in

1996 by the

Centers for Medicare & Medicaid Services as part of its national effort to reduce improper payments caused by duplicate billing, unbundling, and incompatible procedure reporting. CMS created CCI to standardize coding rules across Medicare claims and ensure that services billed together reflect clinically appropriate, medically necessary care. Over time, the initiative evolved into what is now known as the

National Correct Coding Initiative (NCCI), expanding beyond Medicare to influence Medicaid programs and many commercial payers. The primary objective has remained consistent: prevent payment errors, protect program integrity, and establish uniform coding logic that can be enforced at scale through automated claims processing.

CMS Source Link

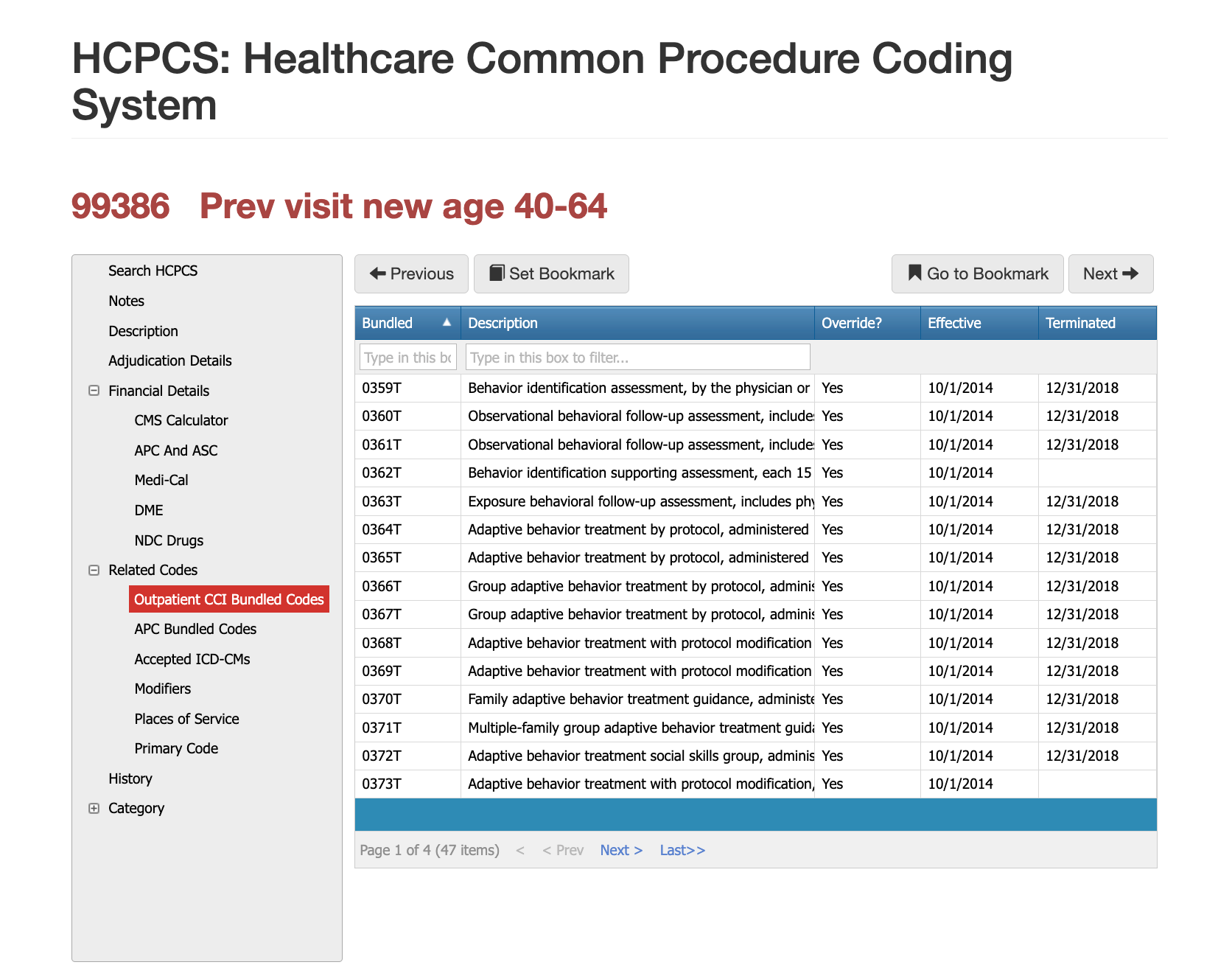

Types of CCI Edits

Mutually Exclusive Edits

Mutually exclusive edits identify procedures that cannot reasonably be performed together during the same encounter. These are services that represent alternative approaches or conflicting methods of treatment. When both codes appear on the same claim, one will be denied.

Bundled (Column 1 / Column 2) Edits

Bundled edits identify services that are considered integral to a more comprehensive procedure. In these cases, the more comprehensive service is payable, while the component service is not separately reimbursed unless a recognized modifier is appropriately applied.

What is the National Correct Coding Initiative (NCCI)

The National Correct Coding Initiative (NCCI) is the formal CMS program that governs CCI edits. NCCI applies standardized coding logic across Medicare Part B claims and has been adopted—fully or partially—by many Medicaid programs and commercial payers.

- NCCI edits are updated quarterly and reflect changes in:

- CPT and HCPCS codes

- Clinical practice standards

- CMS payment policy

Because updates occur throughout the year, relying solely on printed code books or static reference materials often leads to outdated billing logic.

How CCI Edits Affect Payers & Providers

CCI Edit Impact on Payers

For payers, CCI edits are a critical payment integrity control. They help prevent overpayments caused by unbundling, duplicate billing, and modifier misuse. At scale, even small coding inconsistencies can translate into significant financial exposure.

CCI edits also play a central role in audits. CMS and OIG reviews routinely compare paid claims against NCCI logic to assess whether improper payments occurred—and whether plans had adequate controls to prevent them.

However, enforcement introduces operational challenges. Claims flagged by CCI logic may require manual review, provider outreach, or appeal resolution, increasing administrative burden when controls are not automated or aligned across systems.

CCI Edit Impact on Providers

For providers, CCI edits directly impact claim acceptance, payment timeliness, and revenue predictability. Violations often result in denials or partial payments, even when services were clinically appropriate but coded incorrectly.

Providers who perform multiple procedures in a single encounter face a higher risk, notably when documentation does not clearly support separate and distinct services. Inconsistent understanding of modifier use and quarterly NCCI updates further compounds compliance challenges. Repeated CCI-related denials can also trigger payer scrutiny, audits, and contractual disputes.

Modifiers affect both Payers and Providers

Modifiers play a critical role in CCI logic, but they are also a frequent source of audit risk. Modifiers such as -59 and its subsets are intended to signal legitimate exceptions to bundling rules—not to override them by default.

CMS and OIG audits routinely examine whether modifiers were:

- Clinically justified

- Properly documented

- Applied consistently across providers and service lines

- Improper modifier use is one of the most common causes of CCI-related audit findings.

Here are some modifier articles we've written to further illustrate specific examples:

Modifer 25,

Modifer 79,

Modifier 78,

Modifer 51 vs 59,

Modifier FS.

How often are CCI Edits changed?

This is the hardest part for both payers and providers... CCI edits can change, or new edits can be added every quarter. Even worse is that a change that is launched after the quarter begins can be issued to be administered retro-actively to ensure optimal compliance and savings.

How to Stay Current with CCI Edits every quarter

CCI Edits will continue to be a primary compliance and cost containment issue

CCI edits are not static rules. They evolve alongside medical practice, regulatory priorities, and trends in fraud enforcement. As CMS and OIG increase scrutiny of payment accuracy, organizations without automated, up-to-date CCI controls face growing financial and regulatory exposure. Maintaining compliance requires more than knowing what a CCI edit is—it requires operational systems capable of enforcing those rules consistently across claims, contracts, and audits.

How AI will help us all stay compliant

Artificial intelligence has become an essential tool in managing CCI complexity. AI does not replace coders, auditors, or clinicians—it augments their ability to apply evolving rules consistently and at scale.

For Medical Clinics

AI-assisted coding tools analyze clinical documentation against current NCCI logic, identifying incompatible code combinations before claims are submitted. This reduces denials, rework, and revenue leakage while supporting compliant billing practices.

For Payers

AI-driven claims auditing systems evaluate paid and pre-payment claims against NCCI edits, modifier logic, and historical billing patterns. This enables earlier detection of improper payments, strengthens audit defensibility, and improves overall payment accuracy.

How PCG is helping Payers with CCI Edits

PCG helps payer organizations operationalize CCI and NCCI compliance across both pre-payment and post-payment workflows. Through AI-driven claims auditing, PCG enables payers to evaluate claims against current NCCI logic, modifier rules, historical billing patterns, and CMS payment policy—every night, at scale. This allows plans to detect improper payments earlier, reduce overpayment exposure tied to unbundling and modifier misuse, and strengthen audit defensibility during CMS and OIG reviews.

Beyond payment accuracy, PCG supports payer compliance teams by aligning claims configuration, contract logic, and audit reporting. This ensures that CCI edits are enforced consistently across delegated entities, legacy systems, and evolving CMS updates. The result is a defensible, repeatable compliance framework that reduces audit findings while improving overall payment integrity.

How PCG is helping Providers with CCI Edits

PCG helps medical clinics and provider organizations apply CCI and NCCI rules accurately before claims are submitted. By using AI-assisted coding and documentation analysis, PCG enables providers to identify incompatible code combinations, improper bundling, and modifier risks in advance—reducing denials, rework, and revenue leakage. This proactive approach supports compliant billing while preserving legitimate reimbursement for services rendered.

In addition, PCG helps providers stay current as CCI edits change throughout the year. Rather than relying on outdated code books or manual reference checks, providers gain continuous visibility into current NCCI logic and its impact on daily coding decisions. This improves consistency across coders, strengthens audit readiness, and supports long-term revenue cycle stability without increasing administrative burden.

Building the Health Plan That Emerges Stronger After Disaster

C-suite leaders must drive readiness across people, process, and technology. Plans that integrate automation, maintain distributed workforces, and establish Disaster Mode protocols recover quickly and maintain market trust. Plans that rely solely on manual processes experience prolonged backlogs, regulatory scrutiny, and strained provider relationships. True resilience is engineered—not improvised.

If your organization wishes to explore AI-assisted and AI-automation, don't hesitate to get in touch with us today to help you plan for disasters, reduce costs every day, and increase compliance.

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

Free Payer Claims Audit

Complete the form, and we'll contact you to schedule an introductory meeting and discuss our FREE 3-year claims audit to identify areas for cost containment and compliance.

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others