CPT Code 99213 - Level 3 Outpatient Established Patient

Quick Summary for 99213 CPT

CPT

99213 represents a

Level 3 established patient office or outpatient visit, used when a clinician evaluates and manages a patient with a stable or uncomplicated condition requiring low medical decision-making or

20–29 minutes of total time spent on the date of service. It is one of the most frequently billed E/M codes in outpatient practice and a major driver of revenue for primary care, specialty clinics, behavioral health providers, and payer adjudication workflows. Because of its high utilization volume, payers audit 99213 claims closely to ensure medical necessity, correct MDM classification, and proper alignment with updated CMS E/M guidelines. This guide explains when 99213 is appropriate, how to document it correctly, and which patterns lead to denials or downcoding.

The Who, What, When for billing and paying for CPT Code 99213

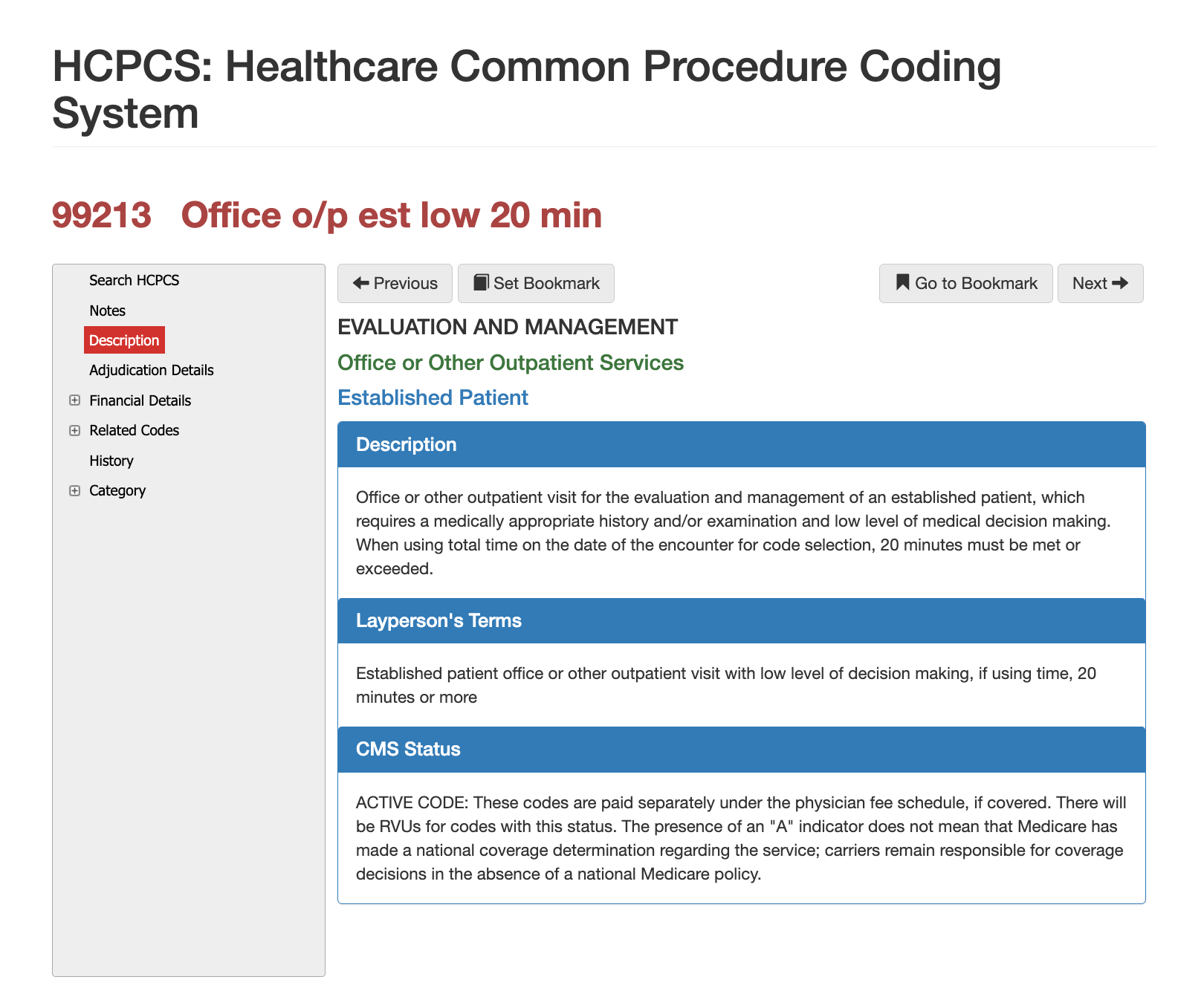

Definition of CPT Code 99213 - AMA vs Layperson:

The AMA defines 99213 as an established patient office or outpatient visit requiring a medically appropriate history and/or examination and low-level medical decision-making, or 20–29 minutes of total time spent on the date of service. Under modern E/M rules, history and examination elements contribute context but do not determine code selection.

In simple terms, 99213 describes a visit with an existing patient who presents with a stable condition or a mildly worsening problem that requires a moderate but not extensive level of evaluation. It represents routine outpatient care that goes beyond a quick check-in but does not rise to the complexity of 99214.

When is CPT Code 99213 Used?

CPT 99213 is appropriate when a clinician addresses a stable chronic illness, evaluates an uncomplicated acute problem, follows up on a prior condition, or manages a treatment change that does not involve high risk. Examples include stable hypertension or diabetes follow-up, musculoskeletal strain evaluation, medication adjustments, minor respiratory symptoms, dermatologic follow-up, behavioral health visits, and uncomplicated injury assessments.

Claims examiners confirm that documentation reflects

low-level MDM, meaning limited data review and low risk of complications, or the time-based requirement of

20–29 minutes. If the visit involves substantial medication changes, diagnostic interpretation, risk escalation, or multi-system review, payers often expect 99214 instead and may flag undercoding or incorrect code selection during audit.

Who bills for CPT Code 99213?

Because 99213 represents one of the most common outpatient codes, it is billed across nearly every specialty. Primary care physicians, internists, pediatricians, psychiatrists, behavioral health clinicians, dermatologists, ENT specialists, orthopedists, OB/GYNs, neurologists, wound care clinicians, and telehealth providers regularly rely on 99213. Nurse practitioners and physician assistants also frequently bill this code when seeing established patients, as permitted by payer policy and state scope-of-practice rules. Due to its prevalence, payers use sophisticated auditing algorithms to evaluate 99213 for patterns of overuse, downcoding, or inconsistent documentation.

Top Diagnosis ICD-10 for CPT 99213

The diagnosis must reflect a condition that reasonably requires a low-complexity evaluation. Common examples include stable chronic diseases under routine management; minor acute issues such as sinusitis, otitis, conjunctivitis, or mild gastroenteritis; dermatologic conditions requiring follow-up; and behavioral health concerns managed through routine medication checks or therapy visits. Payers analyze whether the documented clinical problem aligns with the level of complexity billed. Diagnoses that appear too minor for 99213 or too complex without supporting MDM details often trigger denials or recoding.

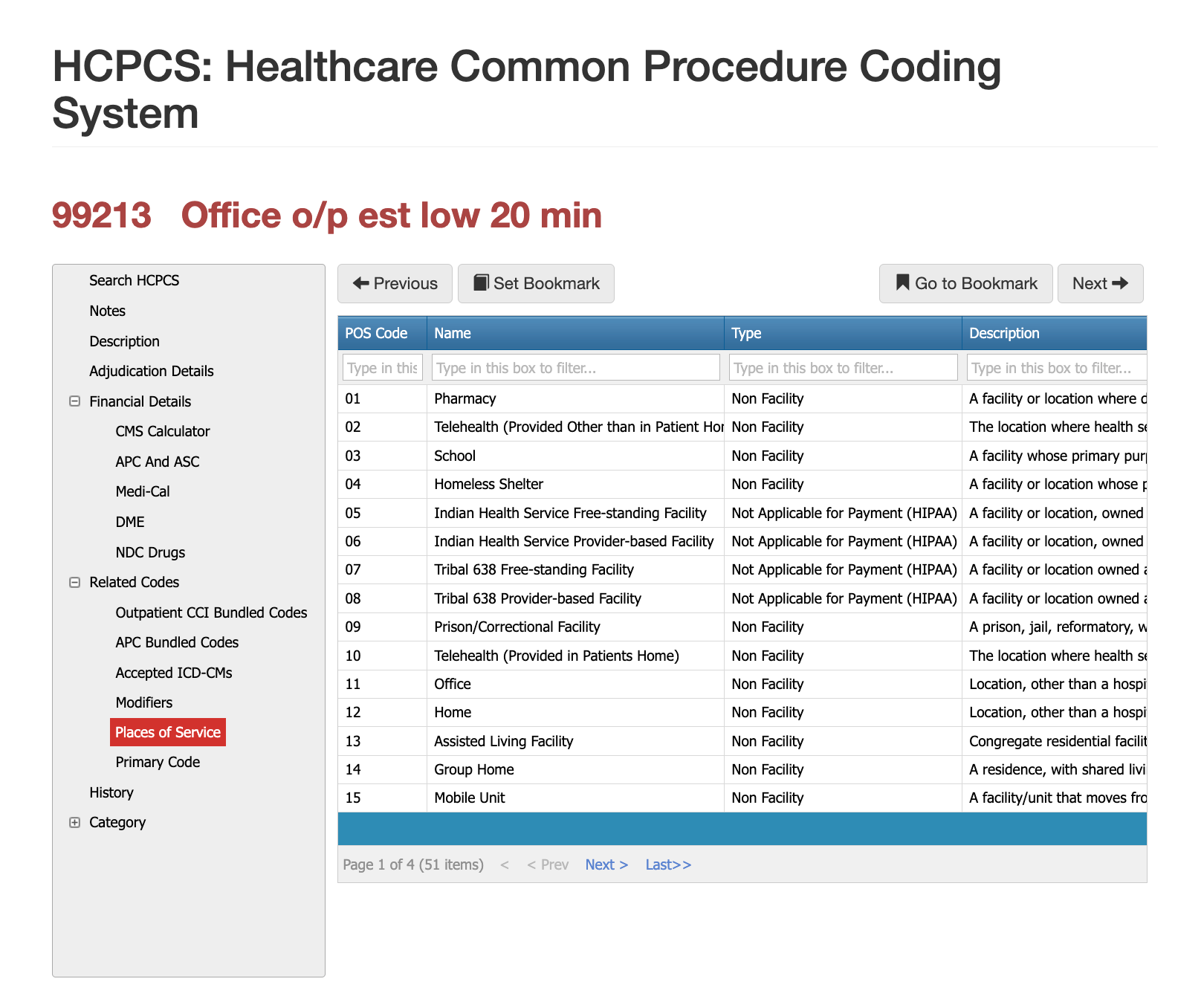

Places of Service for CPT Code 99213

CPT 99213 is billed primarily in outpatient physician offices, specialty clinics, hospital outpatient departments, urgent care centers, and telehealth platforms when payer rules permit. It does not apply to inpatient care, observation services, or emergency department visits. Claims reviewers ensure that the POS code reflects an established patient outpatient encounter and that telehealth claims include modifier 95 when required. Billing 99213 in a non-outpatient setting almost always results in denial.

Proper Documentation for CPT Code 99213

To support 99213, the medical record must demonstrate low medical decision-making or document 20–29 minutes of total time spent on the date of service. MDM documentation should describe the number and complexity of problems addressed, specify data reviewed or ordered, and identify the risk level associated with management choices. Time entries must reflect the sum of all direct and indirect patient care activities performed by the clinician on the date of service, excluding time spent performing separately billable procedures.

Documentation should clearly identify the patient as established; incorrect classification is one of the most common causes of improper payment. Notes should also explain why 99213 was chosen over 99212 or 99214, particularly when the clinical picture or data interpretation suggests a higher or lower complexity level.

Related CPT Codes for 99213

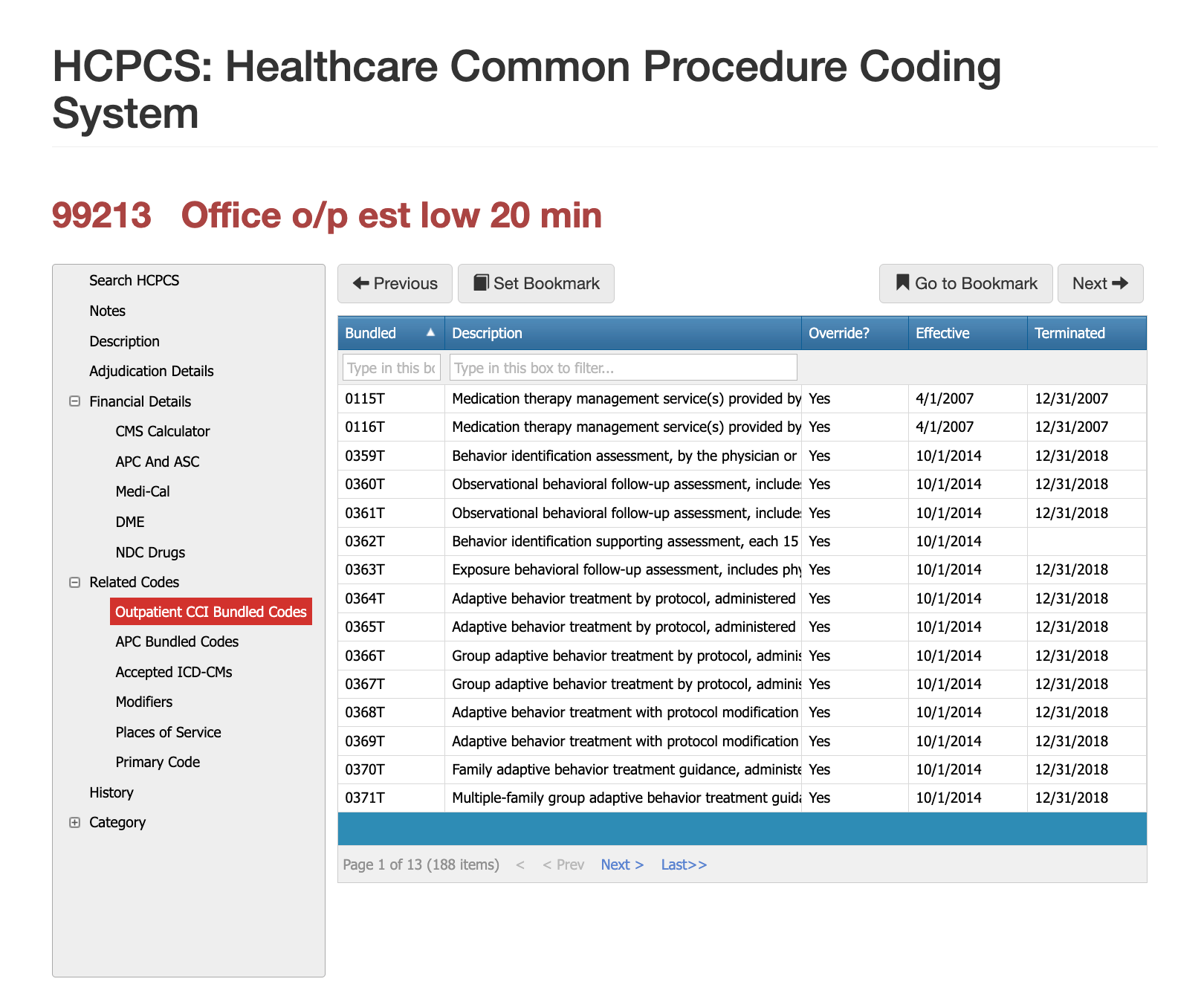

Initial and established patient consults are most commonly confused and/or related to cpt code 99213. The most significant error that can lead to the biggest audits is confusing 99213 (established patient) with 99203 (initial consult). If you continually bill new patient consults with a 3-year episode of care, you can get audited, fined, and even de-delegated for commercial plans. At the same time, Medicare-related claims can result in full sanctions from CMS and the OIG.

To learn more about initial consults cpt code 99203, click here.

| Code | Description | How It Compares to 99213 |

|---|---|---|

| 99212 | Established patient visit, straightforward MDM or 10–19 minutes | Used when evaluation is minimal and complexity is lower. |

| 99214 | Established patient visit, moderate MDM or 30–39 minutes | Selected for more complex visits requiring additional data review or higher-risk decisions. |

| 99203 | New patient visit, low-complexity MDM | Used for new patients; not interchangeable with 99213. |

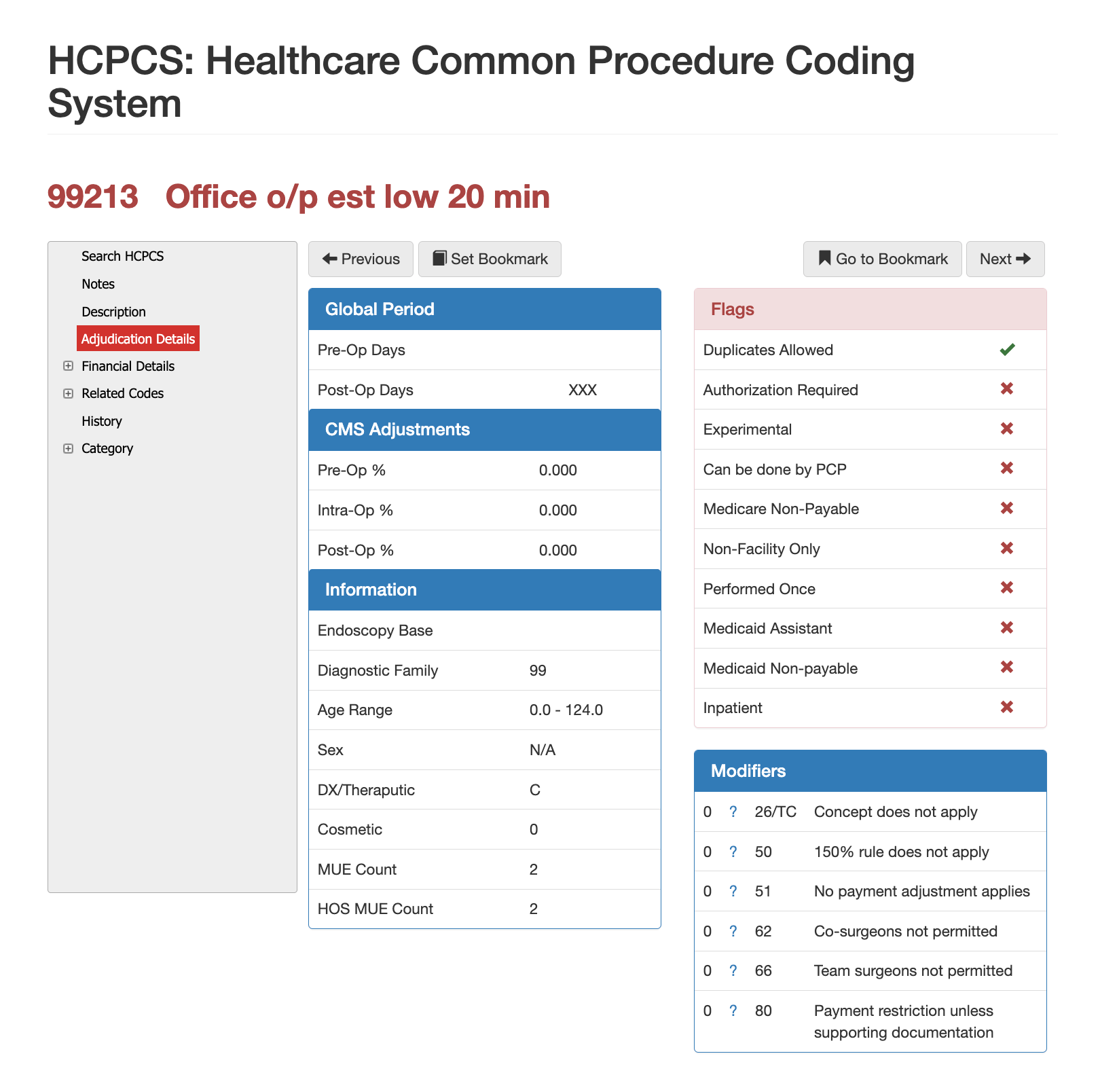

Modifier Guidance for CPT Code 99213

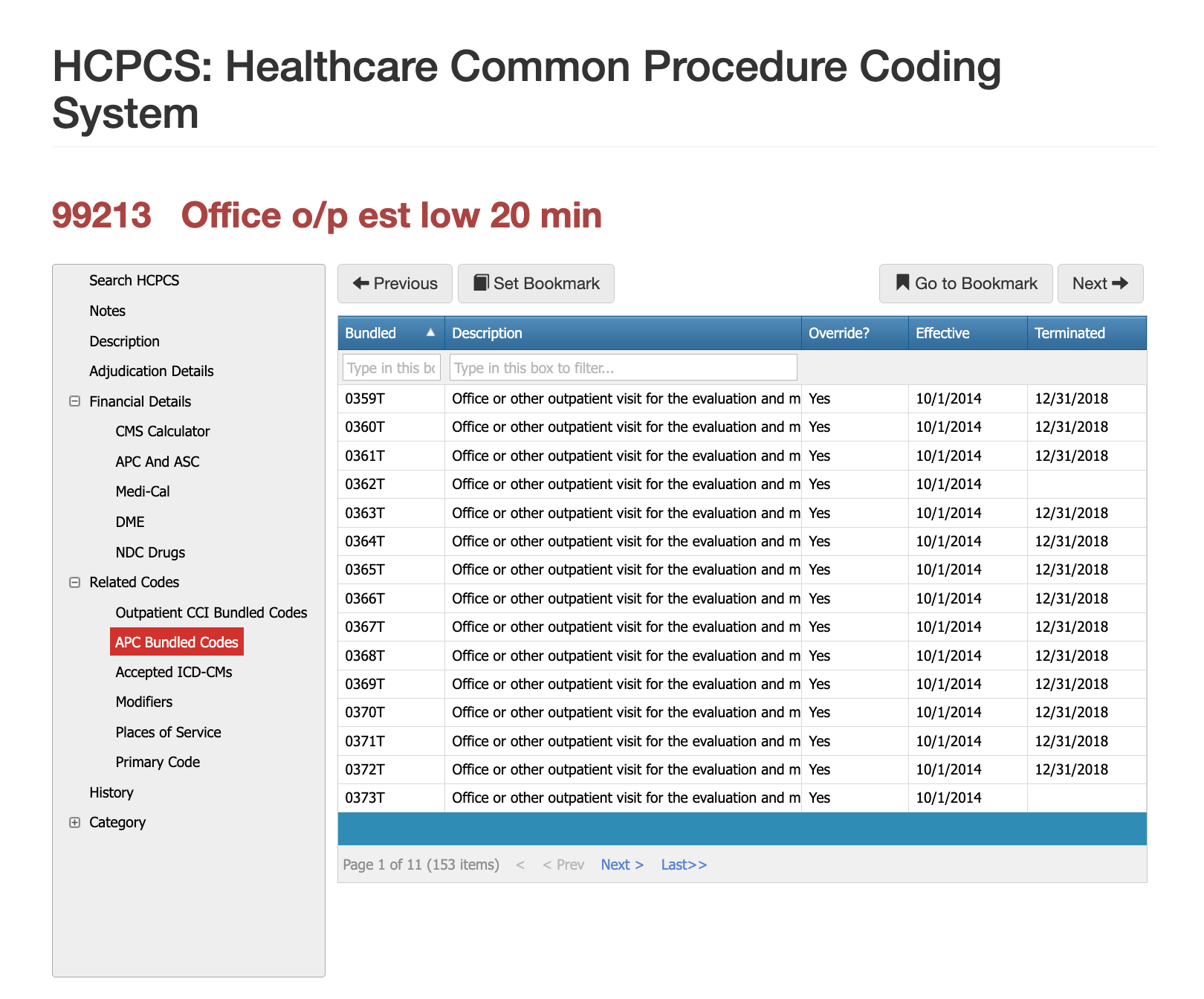

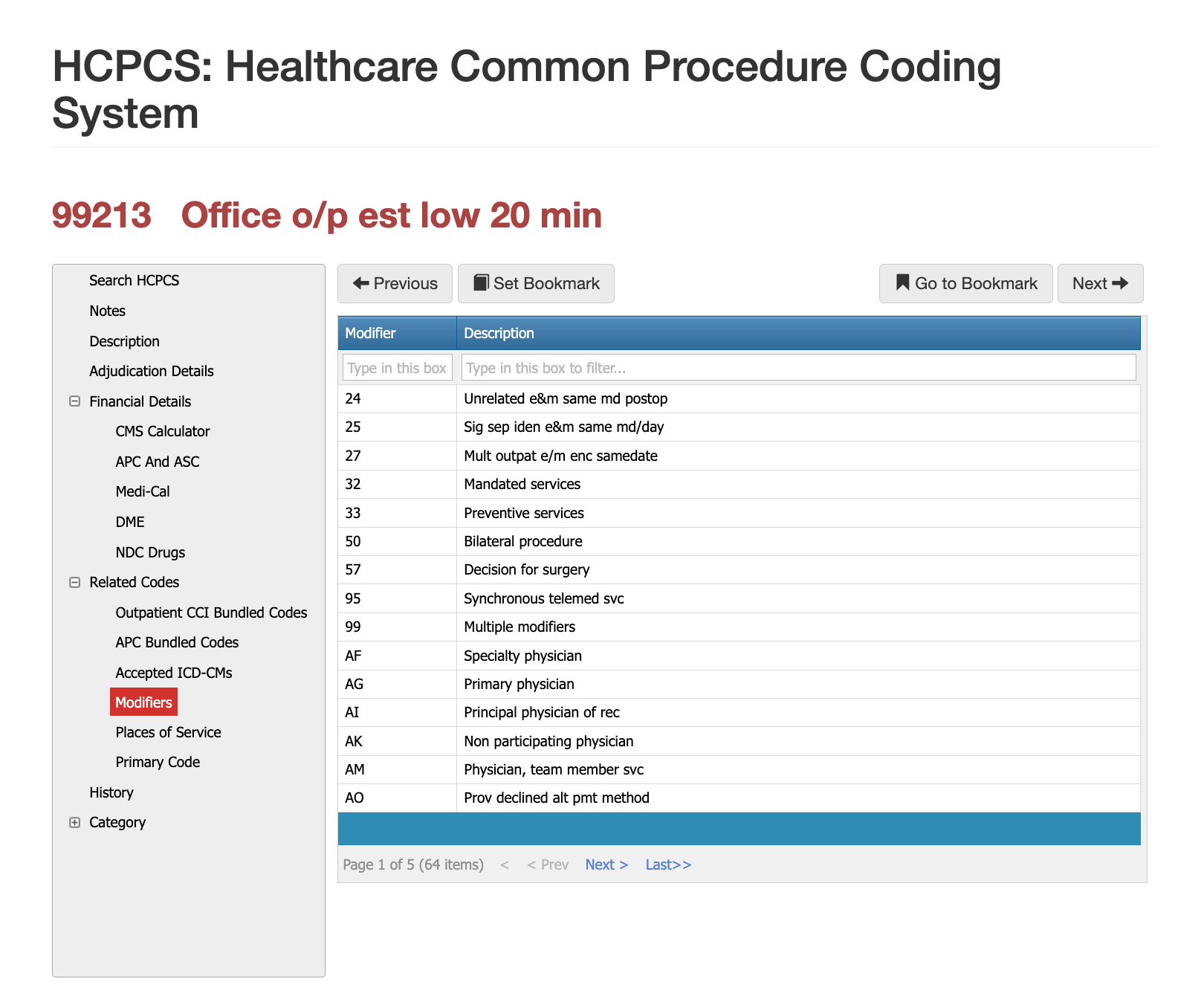

There are over 64 applicable modifiers for 99213, given that it is a follow-up and established patient, but our 30-year history in auditing claims shows that the three most common are Modifiers 25, 95, and 33, which get providers in trouble and possibly signal the need for an audit or sanctions.

Modifier 25 for CPT Code 99213

Modifier 25 is the most common modifier used with 99213 when a clinician performs a minor procedure or diagnostic service during the same visit. The documentation must clearly show that the E/M service addressed a distinct clinical concern beyond the pre-service evaluation inherent to the procedure. Payers frequently deny modifier 25 when the E/M portion is insufficiently documented or when the visit appears to exist solely to perform a procedure.

Modifier 95 for CPT Code 99213

Modifier 95 may be appended when the visit is performed through real-time interactive audio and video technology. Payer policies vary, and some commercial plans limit telehealth use of established patient codes, making it essential to verify coverage rules before billing.

Modifier 33 for CPT Code 99213

Payers most frequently deny 99213 due to insufficient documentation supporting low-complexity decision-making or missing time entries for time-based selection. Another common reason is the mismatch between diagnosis severity and the complexity of the service performed. Denials also occur when modifier 25 is used without evidence of distinct E/M work or when providers incorrectly bill 99213 for a new patient. Audit teams frequently downcode to 99212 when documentation lacks clear MDM, assessment detail, or justification for the visit length.

Most Common Reasons for 99213 CPT Denials

Superficial bone biopsy claims are denied most often when documentation does not clearly distinguish superficial from deep access, when the diagnosis does not justify invasive sampling, or when bundling rules are not followed. Because this procedure often overlaps with imaging guidance, pathology services, and broader musculoskeletal interventions, payers scrutinize these claims closely to ensure medical necessity and correct code selection.

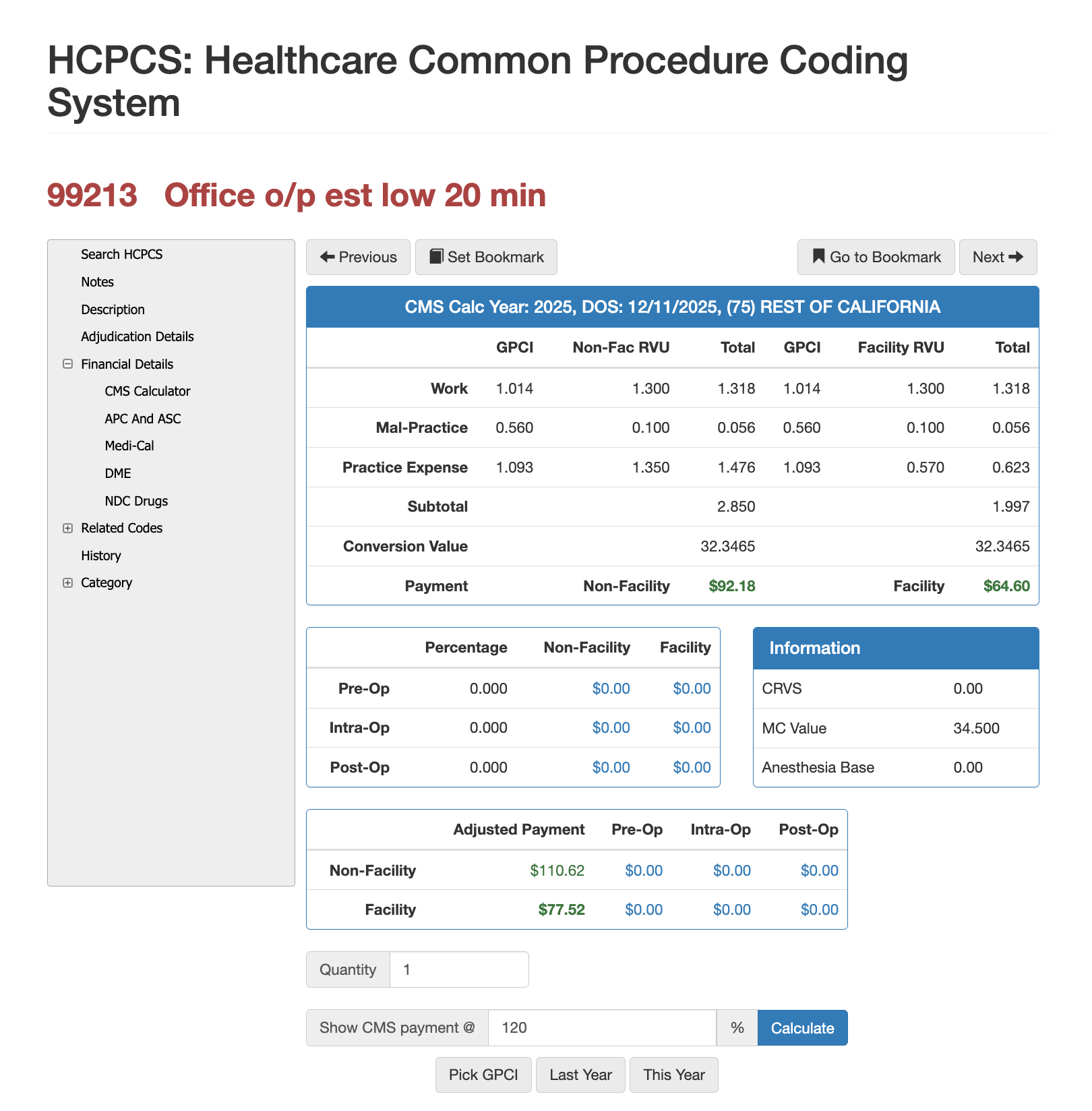

RVUs and Financials for CPT Code 99213

RVU Negotiation Guide for CPT 99213

Reimbursement for CPT 20220 depends on its RVU structure, which includes work RVUs, practice expense RVUs, and malpractice RVUs adjusted through the Geographic Practice Cost Index. Because bone biopsies involve procedural skill and pathology handling, the code carries higher relative value compared to evaluation and management visits. Using Virtual AuthTech on the payer side or iVECoder on the provider side makes it possible to evaluate how reimbursement shifts when different Medicare percentages or geographic adjustments apply. These tools allow users to model payment at 100% of Medicare or alternative contract percentages, compare facility and non-facility rates, and analyze out-of-network pricing. Both payers and providers use these simulations to negotiate fair, compliant rates and ensure that compensation aligns with the complexity of diagnostic bone biopsy work in different regions.

The Easier Way to Research Codes

CPT 99213 remains a cornerstone of outpatient medical billing and a focal point in compliance audits. Ensuring accurate documentation, correct MDM classification, and alignment with payer-specific telehealth policies prevents unnecessary denials and downstream revenue loss. PCG Software’s Virtual Examiner®, VEWS™, Virtual AuthTech, and iVECoder® platforms help both payers and providers maintain consistency in E/M coding, identify documentation gaps, and evaluate claims with confidence. Applying modern decision-making standards across all established patient visits establishes a defensible audit trail and improves long-term compliance.

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others