The Rise and Exit of DOGE: What Payers should expect from it's future impact

From Flashlight to Floodlight: Why DOGE was created

DOGE (Delegated Oversight for Government Enforcement) emerged as a federal watchdog task force in response to persistent audit gaps, questionable vendor oversight, and widespread concerns around Medicare and Medicaid program integrity. It was never designed to become a permanent agency. Instead, DOGE functioned as an intensive investigative body that spotlighted structural compliance failures, particularly within Medicare Advantage, state Medicaid programs, and delegated payer models. Its mission was clear: expose the systemic cracks and recommend fixes.

Audits and Accountability: DOGE's Core Findings

How DOGE First Approached Healthcare

DOGE's job is to find fraud, waste, abuse, and provide innovations and savings to taxpayer dollars. However, they had to remain fair and balanced and look at all industries. So when they approached US Healthcare, they had a beast of an assignment... "Where does the US Government fail it's taxpayers and how much?"

Within US Healthcare there is Medicare, Medicare Advantage, Medicaid, First Grants for Federally sponsored plans like 340B and FQHCs. DOGE decided to look at the biggest taxpayer contribution, a contribution that each and everyone of us pay into within every paycheck. Medicare.

But that's too vast, so they looked at what sector of Medicare was increasing it's costs the fastest, and the answer was Medicare Advantage. As you know, Medicare Advantage is the program where a private payer like UnitedHealthCare, Elevance, and Humana will administer Medicare on CMS's behalf. DOGE already knew there would be problems, because they had seen this same pattern in the form of NGOs and the misallocation of funds for programs like Condoms to Africa.

Audits, Accountability, and Getting the OIG to Act

One of DOGE's primary functions is to assess and either improve or kill a program. But to do that, you must first audit the system. That's where your payer organization began to feel the pressure. During its brief but intense tenure, DOGE audited over 494 Medicare Advantage contracts—a dramatic increase from the previous baseline of 69 contracts. This accounted for oversight of 87% of MA beneficiaries, with the stated goal to audit every plan in the U.S. within 1–2 years. Its reviews focused heavily on delegation oversight, improper payment patterns, and questionable financial arrangements masked by non-transparent vendor contracts. Many audits resulted in findings of non-compliance related to utilization management, modifier misuse, unsupported HCCs, and inaccurate encounter submissions.

DOGE Found and Restated that Billions in Taxpayer Dollars is Mismanaged

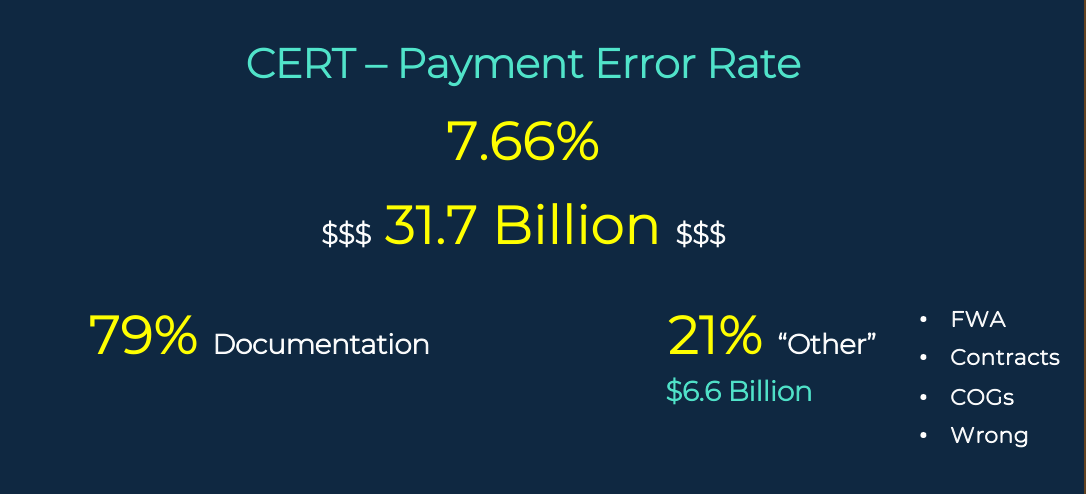

DOGE directly aligned its priorities with CMS's

CERT (Comprehensive Error Rate Testing) program, which found a

7.66% improper payment rate, equaling

$31.7 billion annually. Strikingly,

79% of these errors were documentation-related. DOGE investigators followed these patterns to uncover gaps in both payer compliance and their delegated entities. It amplified CMS’s growing concern over vendors submitting claims and encounter data without proper oversight.

Sources:

CMS FWA Report,

OIG FWA Report

DOGE Shined the Light on Lack of Audits and Sanctions

DOGE didn’t just highlight inefficiencies—it exposed fraud-enabling environments. Delegated vendors were found bypassing edit logic, inflating claims with invalid codes, or denying services without clinical backing. DOGE’s message was loud:

"Delegation is not abdication." Plans must enforce oversight even when operational duties are outsourced. This shifted how CMS and OIG define payer accountability and led to an uptick in

civil monetary penalties ranging from $25K to $500K per violation.

The Future Impact of DOGE on Healthcare

Despite its effectiveness, DOGE was sunset by federal leadership under the belief that it had served its purpose. It wasn't failure—it was fulfillment. Upon disbanding, many of DOGE’s auditors, data analysts, and enforcement advisors were reassigned to agencies like

CMS, OIG, DOJ, and

GAO (Government Accountability Office). Their investigative frameworks and audit triggers are now embedded in day-to-day compliance audits, especially across Medicare Advantage and Medicaid risk arrangements.

Delegation Enforcement Isn’t Optional

In states like California, DOGE pushed regulators (DMHC, DHCS) to enforce longstanding but underused rules requiring plans to manage vendor compliance. If a plan delegates claims, SIU, or authorizations, it remains responsible for the outcomes. Plans must now implement structured oversight programs, audit trails, and corrective action protocols—all of which DOGE highlighted as missing or insufficient in many 2024–2025 audits.

For Medicaid specifically, states are stepping up enforcement through managed care contracts and routine performance scorecards. State agencies such as DHCS in California or HHSC in Texas are increasingly holding Medicaid Managed Care Organizations (MCOs) accountable for poor vendor oversight, encounter data errors, and late payments tied to third-party administrators. Repeated compliance violations or corrective action failures can lead to severe penalties—including de-delegation, capitation withholds, or loss of state contracts.

The consequences of inadequate delegation oversight aren’t just regulatory—they’re operational. Plans that fail to comply with Medicare or Medicaid oversight requirements may face public de-scoring, STAR rating downgrades, or risk-based capital restrictions. More importantly, these issues often lead to breakdowns in provider trust. When key network providers experience repeated authorization delays, payment errors, or documentation disputes due to vendor failures, they may exit the network. Loss of anchor providers or high-volume medical groups directly impacts member access, satisfaction, and retention—putting plan membership and revenue at risk.

Delegation enforcement isn’t optional—it’s foundational to payer credibility, sustainability, and audit survival in today’s healthcare economy.

Payers Must Separate Claims and Compliance Teams

In the wake of DOGE’s findings, payer organizations must take active, ongoing steps to strengthen compliance and protect their delegated relationships. It starts with investing in people. Medical management, claims operations, and compliance teams need experienced professionals—not just to handle regulatory requirements, but to anticipate and adapt to them. Building out internal audit teams and empowering them with both authority and support is no longer optional.

Equally important is technology investment. Compliance isn’t static—CMS and OIG release new rules, modifiers, and encounter guidance every quarter. Plans must implement systems like Virtual Examiner that not only scan claims in real time for coding and documentation violations, but also adapt automatically to these updates. Legacy systems and manual workflows can’t keep pace with federal scrutiny.

Finally,

improving provider relations has become a strategic compliance function. Plans should proactively educate their provider networks about coding changes, documentation expectations, and policy shifts. Hosting quarterly compliance webinars or offering consulting support can help prevent upstream issues that delay care, cause unnecessary denials, or fuel FWA through external billing companies. Plans that collaborate—not just contract—with their providers are better positioned to meet CMS’s increasing standards.

Account for Taxpayer Spending on Vendors and Technology

In today’s compliance-driven and publicly accountable environment, health plans must be highly selective about the technology and consulting partners they engage. With increased attention from regulators—and under the transparency standards of the Sunshine Act—plans are expected to justify how they spend taxpayer-funded dollars. Overpriced systems and generic consulting services with limited payer-specific relevance not only inflate operational costs, but also undermine compliance goals.

Too often, health plans inherit bloated contracts or legacy tools that fail to meet evolving CMS audit requirements. These inefficient systems delay corrective action, drain resources, and can even worsen audit exposure. Plans should seek out partners who specialize in Medicare Advantage, Medicaid, and delegated care delivery models—with a proven ability to drive down error rates and support defensible audits. Ask vendors for real-world impact metrics, updated compliance roadmaps, and proactive regulatory updates. In short: if they can't prove their value, they shouldn't be on your compliance team.

DOGE Pushed the AI Agenda on Payers

As federal scrutiny intensifies, payer organizations are under pressure to do more with less—without violating regulatory guardrails. Strategic automation, when implemented correctly, can improve compliance, streamline operations, and enhance both accuracy and member experience.

AI-Powered Claims Auditing

No one goes to college to become a claims auditor. You have to learn on the job which makes hiring for claims and compliance in healthcare so hard. So the key takeaway from DOGE is hire great experienced individuals, and automate as much as you can so you can spend more time on complex claims, reviewing provider contracts, and saving time and money.

AI-driven claim auditing systems, like

PCG’s Virtual Examiner®, scan 100% of claims in real-time against updated CCI edits, MUEs, and client-specific logic. These systems flag errors before payment, reducing downstream audits and recovery efforts. Unlike static rules engines, AI systems dynamically learn from patterns—helping identify fraud, waste, and abuse across multiple payers and provider types.

AI Claims Auditing - How it Works

Modern AI-driven claims auditing systems operate by applying established CMS, AMA, and payer-specific edit logic at scale—before payment is released. Common pre-pay detections include Correct Coding Initiative (CCI) conflicts, wrong-sex edits where anatomy-specific procedures are billed for an incompatible gender, invalid or outdated place-of-service codes, and terminated or deleted CPT/HCPCS codes that no longer meet billing requirements. These errors are not clinical judgments—they are administrative and coding failures that routinely drive improper payments, rework, and downstream audits when missed. By identifying these issues in real time, AI auditing reduces avoidable denials, prevents overpayments, and limits post-payment recovery activity that strains provider and payer relationships.

AI Claims Auditing Example: Wrong Sex

AI pre-pay claims auditing catches anatomy- and gender-specific inconsistencies before they become improper payments, audits, or provider abrasion.

Example one: a claim bills a prostate exam/prostate procedure code for a 58-year-old female member—an immediate demographic mismatch that should be stopped for correction because the clinical scenario cannot reconcile with member sex on file.

Example two: a claim bills a “full removal of ovaries” procedure for a 48-year-old male member—again, a hard stop that signals either a member eligibility/data issue, a charting/coding error, or a claim keyed to the wrong subscriber. In both cases, the fastest path is not post-payment recovery; it is real-time identification, correction, and resubmission while the provider still has the chart open and the payer avoids downstream rework.

AI Claims Auditing Example: Terminated Codes

CPT/HCPCS and diagnosis code sets are not static—coding rules, deletions, and policy constraints change continuously, and payers are expected to keep edits aligned with CMS guidance and payer policy. A common failure pattern is the submission of a code that has been deleted/terminated, replaced, or no longer payable under current rules, which forces retroactive denials, provider disputes, and corrective mass reprocessing. AI auditing flags these “stale code” scenarios at the moment of adjudication by cross-referencing current code status, effective dates, and payer-specific payment policy, rather than letting the claim age into a compliance problem. The operational takeaway is simple: quarterly (or more frequent) code and edit updates are not an IT preference—they are a payment integrity control that prevents avoidable improper payments and protects provider relations.

AI-Powered Authorizations

Using AI for utilization management can speed up routine decisions, reduce staff burnout, and improve turnaround time—without sacrificing compliance. Trained AI models can analyze clinical documentation to issue faster decisions on low-risk authorizations (like DME or diagnostic imaging), while flagging higher-risk cases for manual review. This hybrid model reduces delays in care and keeps plans within CMS timeframes.

AI Authorizations - How it Works

Modern AI-driven claims auditing systems operate by applying established CMS, AMA, and payer-specific edit logic at scale—before payment is released. Common pre-pay detections include Correct Coding Initiative (CCI) conflicts, wrong-sex edits where anatomy-specific procedures are billed for an incompatible gender, invalid or outdated place-of-service codes, and terminated or deleted CPT/HCPCS codes that no longer meet billing requirements. These errors are not clinical judgments—they are administrative and coding failures that routinely drive improper payments, rework, and downstream audits when missed. By identifying these issues in real time, AI auditing reduces avoidable denials, prevents overpayments, and limits post-payment recovery activity that strains provider and payer relationships.

AI Authorizations Denials

AI-enabled authorization intake reads the inbound request via EDI (or structured portal data), validates it against rule logic, and immediately returns a correctable response when the request is non-compliant or incomplete. The same categories that break claims also break authorizations: wrong sex for anatomy-specific services, invalid/outdated place-of-service, missing/invalid diagnosis-to-procedure linkage, or use of codes that are terminated or not payable under the plan’s current policy. The goal is not to “deny care”; it is to bounce the auth back in minutes with a precise defect reason so the provider can correct the data and resubmit cleanly—reducing manual UM queue time, preventing pend cycles, and improving turnaround time without relaxing compliance guardrails.

AI Authorizations Approval

AI-enabled authorizations approve faster when the request is clean, coded correctly, and matches a low-risk rule path—especially for true emergency scenarios where speed matters and the criteria are straightforward. For example, an emergency visit submitted with valid, current diagnosis and procedure coding, a consistent place of service, and no demographic conflicts can be auto-approved immediately, while the system still logs the decision pathway for oversight and downstream review. This is where “automation before the claim hits the system” changes outcomes: the provider gets a timely authorization, the member avoids delays, and the payer reduces manual touches while preserving an auditable trail. The net effect is fewer avoidable denials later, fewer corrected claims, and a smoother experience across the entire payment lifecycle.

AI for Non-Clinical Tasks

Artificial intelligence can streamline dozens of administrative tasks beyond claims and UM:

- Generating provider performance scorecards

- Predicting audit triggers

- Analyzing STAR and CAHPS trends

- Handling eligibility and benefits lookups

- Automating marketing analytics

- Running financial forecasting

- Managing contract tracking

- Overseeing credentialing workflows

- Performing regulatory research

- Surfacing retention risks in high-need member populations

Investing in non-clinical automation can reduce overhead and reallocate human effort toward high-value compliance and patient support work.

5 Signs Your AI Technology is Hurting, not Helping

- The software doesn't update every quarter, as CMS and AMA require.

- They can’t show historical data on error reduction or compliance KPIs.

- Their platform lacks explainability—no audit trail or transparency on denial or reduction reasoning.

- Software updates are reactive to client requests, compliance audits, and sanctions.

- Lack of customization for Line of Business and/or single provider contracts.

The Easier Way to Research codes

For more than 30 years, PCG Software has supported Health Plans, MSOs, IPAs, TPAs, and provider organizations in improving coding accuracy, strengthening compliance, and reducing fraud, waste, and abuse. Our solutions, including Virtual Examiner®, VEWS™, and iVECoder®, are built on decades of payer-side adjudication experience and reflect the same logic used by health plans nationwide. National regulatory guidance, payer policies, compliance standards, and large-scale claims review patterns inform this CPT 69210 analysis.

Toss out the CPT book.

Stop researching articles.

Sign up for iVECoder today!

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

Free Payer Claims Audit

Complete the form, and we'll contact you to schedule an introductory meeting and discuss our FREE 3-year claims audit to identify areas for cost containment and compliance.

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others