CPT Code 82310: Calcium Test Interpretation, Billing, and Compliance Guide

What you'll learn about 82310 CPT

CPT Code 82310 is used for a quantitative calcium test performed on serum, plasma, or whole blood. This test is a core part of metabolic evaluations, renal workups, and endocrine assessments. In this guide, we break down how the code should be used, who bills it, documentation requirements, bundling rules, NCCI edits, modifiers, RVUs, and compliance considerations from a payer and claims-examiner perspective. This article is written to support coding accuracy, prevent denials, and help both providers and payers maintain consistent adjudication standards.

The Who, What, and When of CPT Code 82310

Official Definition and Lay Explanation

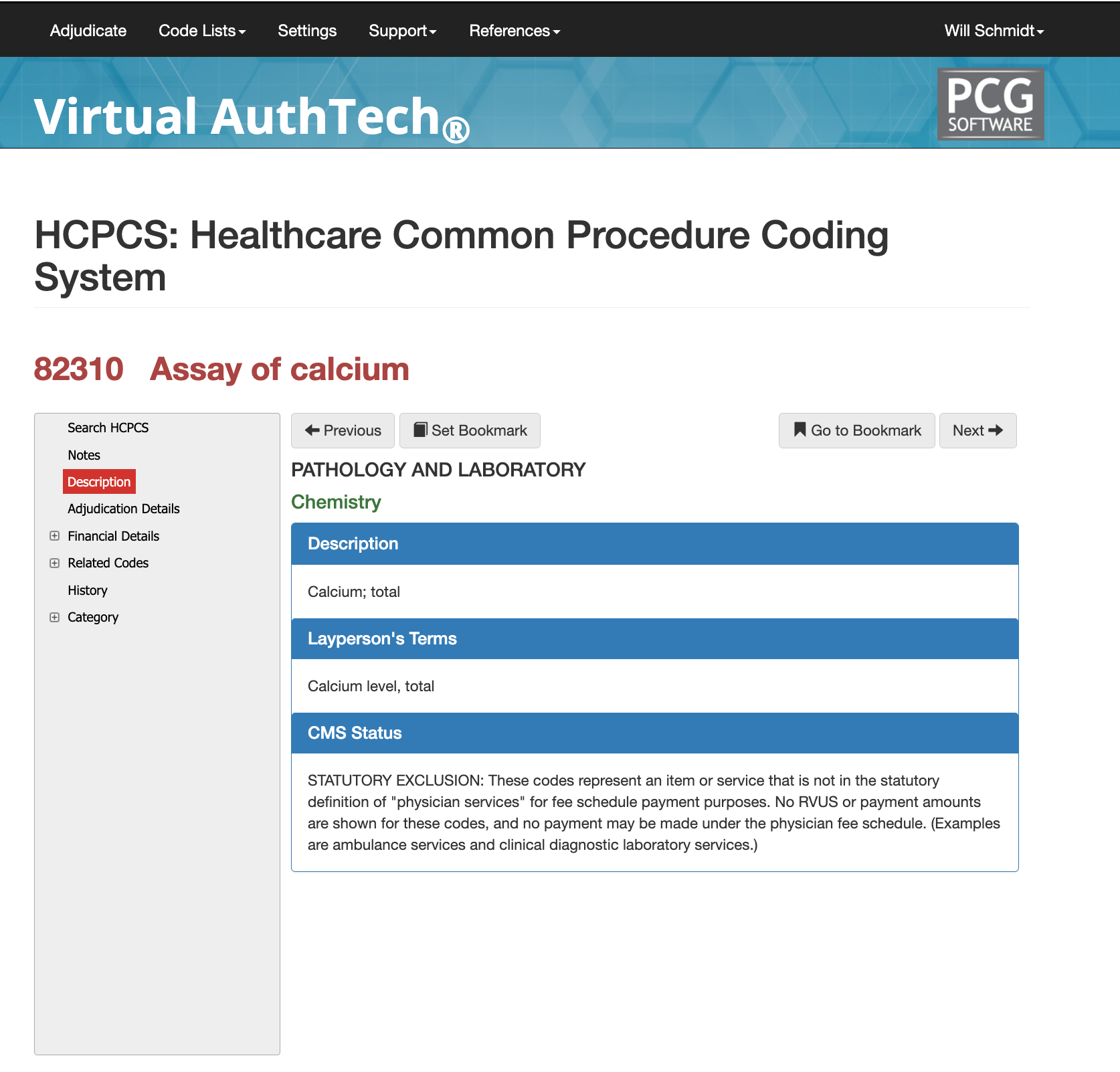

CPT 82310 reports the quantitative measurement of calcium in blood using standard laboratory chemistry methods. It is used to diagnose electrolyte imbalance, kidney disease, parathyroid disorders, and metabolic abnormalities. Payers expect this code to be used only when the test is medically necessary and not already included in a larger chemistry panel.

What this test measures?

CPT 82310 measures total calcium concentration in the blood. Calcium plays a role in muscle contraction, bone strength, nerve signaling, and hormone function, so abnormalities are clinically significant.

Why Calcium Testing Matters Clinically

Providers use this test to evaluate parathyroid function, kidney disease, bone disorders, malignancy-related hypercalcemia, electrolyte abnormalities, and critical-care imbalances.

When This Test Is Medically Necessary

Medical necessity exists when a patient has symptoms or risk factors for calcium imbalance, such as fatigue, arrhythmias, kidney stones, osteoporosis, endocrine disorders, or suspected malignancy.

When is CPT Code 82310 used?

This code must only be used when a stand-alone calcium test is ordered and performed. If the test is part of a larger chemistry panel, payers may deny separate billing due to bundling rules.

Routine Chemistry Panels vs. Stand-Alone Testing

82310 is not appropriate when calcium is included in:

- 80048 Basic Metabolic Panel

- 80053 Comprehensive Metabolic Panel

When billed separately in these cases, payers almost always deny it.

utpatient vs. Inpatient Use

Outpatient labs use 82310 for stand-alone testing.

In inpatient settings, the code may be present but often rolls into DRG-related payments.

When NOT to Use 82310

Do not report 82310 when:

- The test is part of a bundled panel

- The order is screening without medical necessity

- Documentation does not include a supporting diagnosis

Who bills for CPT Code 82310

The test is almost always billed by labs, not ordering physicians. However, ordering patterns help payers determine whether use is appropriate.

Hospital Laboratories

Hospital labs bill 82310 during outpatient visits, emergency evaluations, and pre-operative panels.

Independent Reference Labs

National and regional diagnostic laboratories bill 82310 for outpatient orders, routine metabolic checks, and chronic disease management.

Endocrinology, Nephrology, and Primary Care

These specialties order calcium testing most often, but they rarely bill it—the laboratory doing the analysis typically does.

Ordering vs Billing Providers

Ordering physicians must justify medical necessity; billing laboratories must produce a compliant report.

Referring Physician Responsibilities

The ordering provider must include:

- A clear diagnosis or symptom

- A valid written/EMR lab order

- Supporting clinical notes

Laboratory Billing Requirements

The lab must document:

- Specimen type

- Methodology

- Numerical result

- Reference range

- Interpretation, when applicable

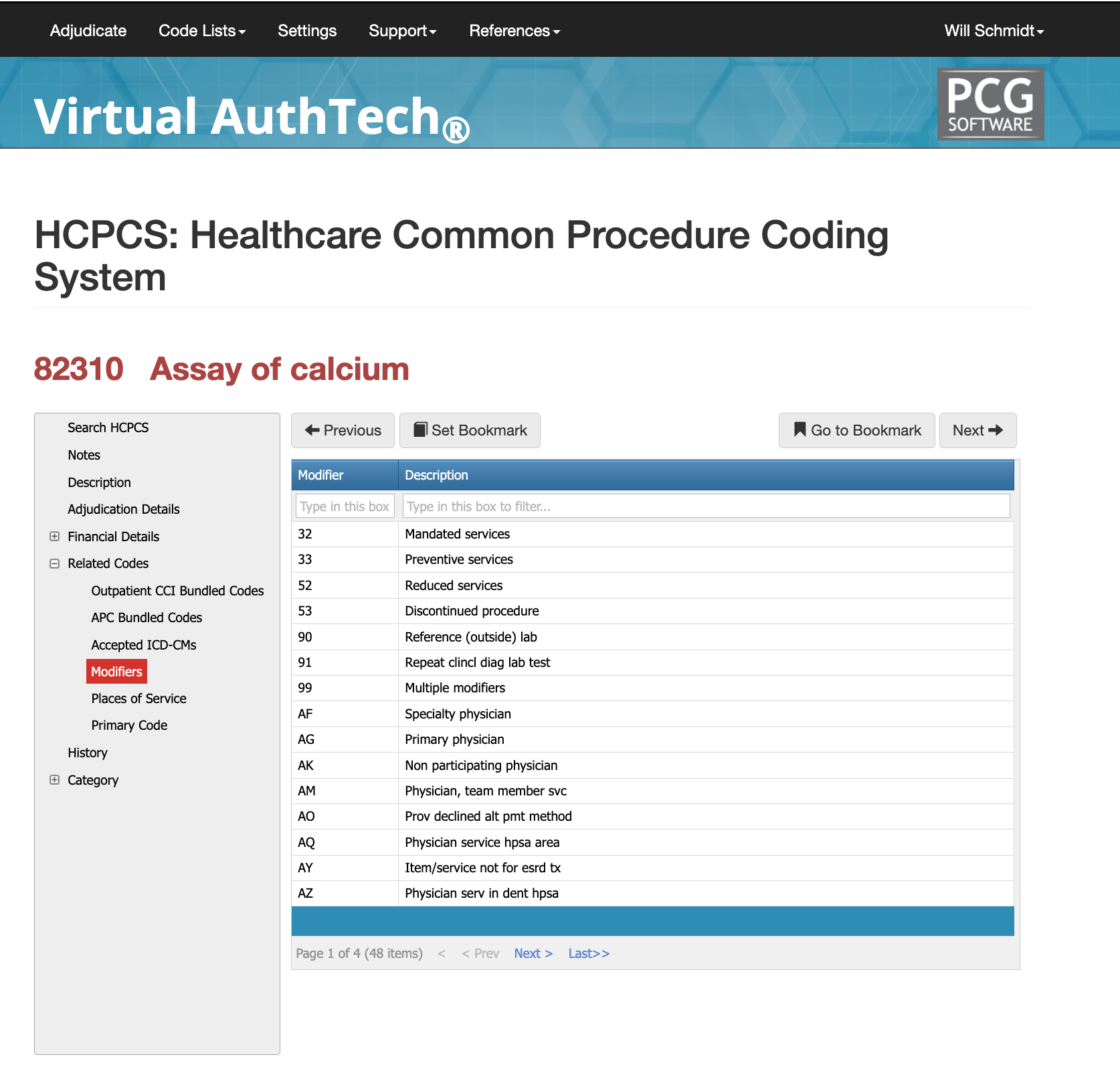

Modifiers for CPT Code 82310

Although CPT 82310 is a straightforward laboratory test, modifiers are sometimes required to show how the service was performed or why it should be paid separately. Using the correct modifier helps prevent bundling denials, duplicate claim denials, or incorrect payment. Below are the three modifiers most commonly associated with calcium testing and when they should be used.

Modifier 26: Professional Component

Modifier 26 is used when the pathologist provides the interpretation only, and the laboratory performs the technical portion of the test. This modifier applies in scenarios where a physician adds a medically necessary interpretive comment to a calcium result. It should not be used when the test is automated and does not require physician review. Claims are often denied when modifier 26 is added without supporting documentation in the pathology report.

Key points:

- Use only when a documented interpretation exists.

- Do not use for routine chemistry testing.

- Payers verify the presence of physician work before allowing payment.

Modifier 59: Distinct Procedural Service

Modifier 59 may be used when CPT 82310 must be billed separately from other laboratory services performed on the same day. This happens when the calcium test addresses a different clinical question than a panel that was also performed. Payers examine documentation closely to confirm clinical separation.

Key points:

- Use only when the calcium test is not part of the panel.

- Documentation must clearly state why the test was ordered separately.

- Improper use of 59 is one of the most common causes of lab denials.

Modifier 91: Repeat Clinical Diagnostic Laboratory Test

Modifier 91 is used when a calcium test is legitimately repeated on the same day to monitor changes in a patient’s condition. For example, patients with kidney failure, electrolyte imbalance, or suspected hypercalcemia may require multiple calcium measurements within a short timeframe.

Key points:

- Only for medically necessary repeat tests.

- Not for lab equipment errors or quality-control repeats.

- Payers require clear time stamps and rationale.

Proper Documentation for More Approvals

Proper documentation is essential for clean claims and compliant billing of CPT 82310. Payers need to see the medical reason for the test, the ordering provider’s intent, and complete laboratory reporting. Calcium testing is often bundled with metabolic panels, so claims examiners look for clear justification for performing the test independently.

Documentation should link the test to a valid diagnosis such as electrolyte imbalance, kidney disease, endocrine disorders, bone loss, or cancer-related hypercalcemia. Vague phrases like “routine labs” or “check bloodwork” often lead to denials. The laboratory report must list the specimen type, testing method, numerical result, reference range, and any factors affecting accuracy.

When multiple tests occur on the same day—such as a panel in the morning and a separate calcium test later—documentation must show the clinical reason for both. This clarity helps prevent bundling denials and supports efficient adjudication.

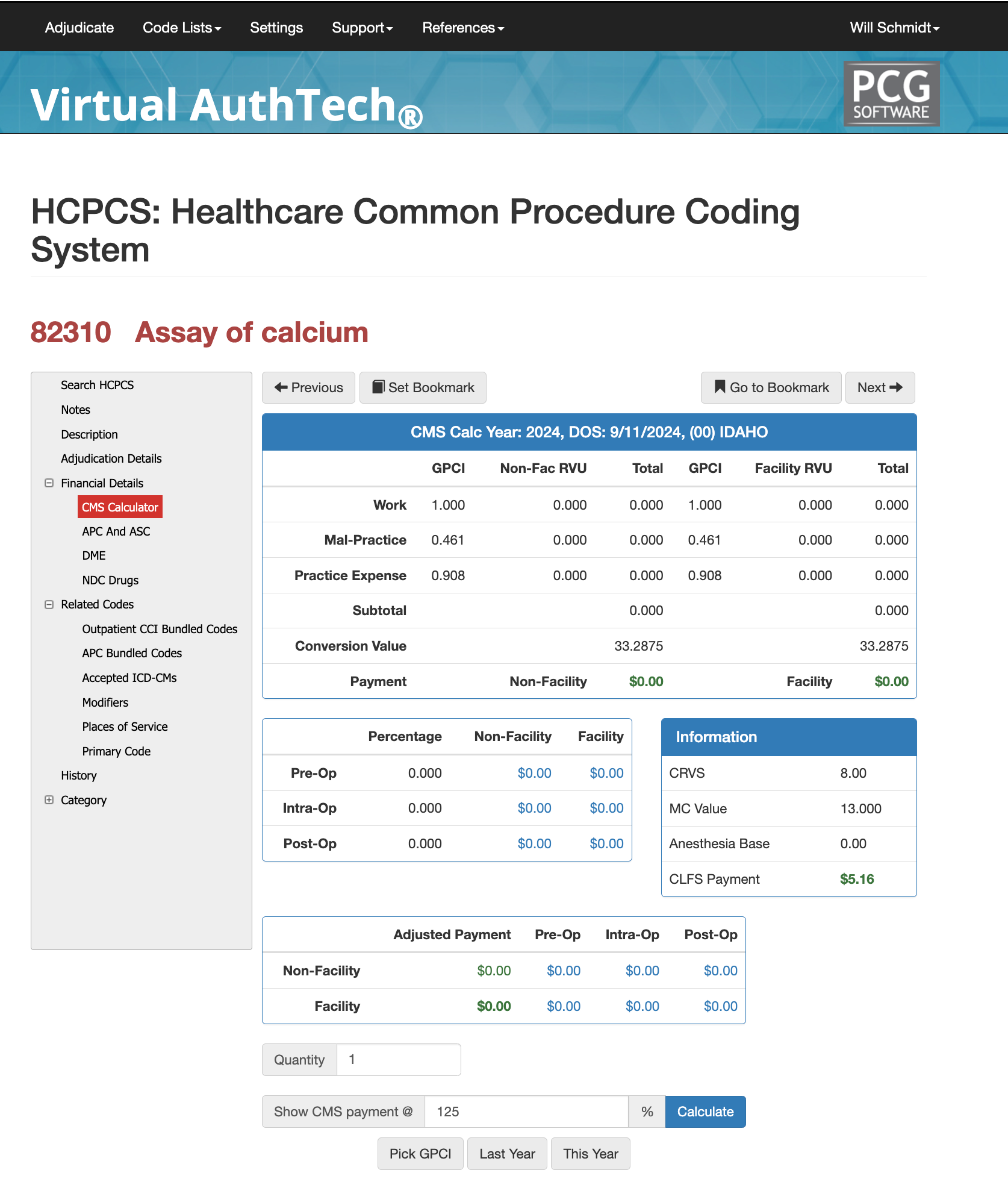

RVUs and Reimbursements for CPT Code 82310

82310 Real World Examples

CPT 82310 is paid under the Clinical Laboratory Fee Schedule, meaning it has no work or malpractice RVUs. All reimbursement comes from the technical cost of running the test. Pathologists only bill a professional component when they provide a separate interpretation with modifier 26.

Outpatient Lab

A clinician orders a stand-alone calcium test for suspected hyperparathyroidism. The independent lab performs the test and bills CPT 82310 globally at the CLFS rate. No professional component is billed.

Emergency Department Repeat Test

A patient receives a metabolic panel in the morning and a repeat calcium test later due to worsening symptoms. The second test may be billed with CPT 82310 + modifier 91 when medically justified.

Hospital Outpatient Setting

In outpatient hospitals, calcium testing may be packaged under APC rules. Even if the test is run, CMS may not issue a separate payment. This packaging rule does not apply to independent labs.

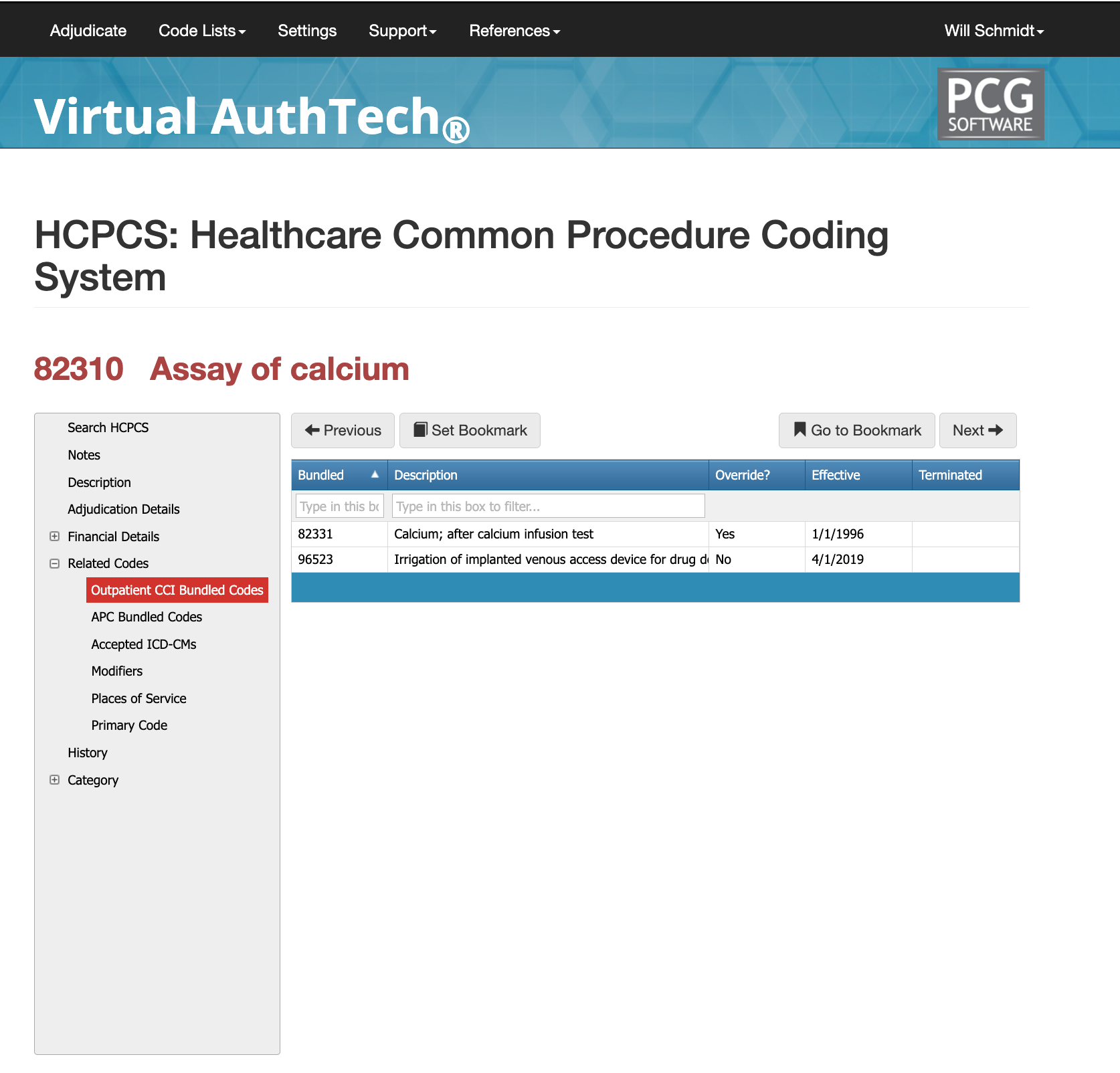

CPT Code 88365 Bundled Codes and Modifiers

CPT 82310 is frequently affected by NCCI bundling edits because calcium is included in many standard chemistry panels. When a metabolic panel (80048 or 80053) is billed, calcium cannot also be billed separately unless a second, medically necessary test was performed at another time.

Claims examiners look for strong documentation explaining why a calcium test was repeated or ordered outside the panel. For example, if a patient’s condition changes significantly, a second calcium test may be billed with modifier 91. Without documentation showing the change in condition, the claim is treated as a duplicate and denied.

Unbundling should never occur simply to separate panel components. Panels represent a complete diagnostic group, and breaking them apart triggers denials and compliance concerns. CPT 82310 is only payable when it is a stand-alone test, ordered for a specific reason, and supported by diagnosis codes that justify independent testing.

PCG Software’s Authority and Expertise in CPT Code Interpretation

For more than 30 years, PCG Software has supported payers, MSOs, IPAs, TPAs, and clinical organizations in improving claims accuracy, preventing fraud and waste, and strengthening compliance around high-volume procedure codes such as 20610. Our solutions—including

Virtual Examiner®,

VEWS™, Virtual AuthTech, and

iVECoder®—apply payer-side adjudication logic, NCCI rules, and multi-year episode-of-care analytics to identify coding errors before payment is released. By combining clinical insight with rule-based automation, PCG helps organizations reduce improper payments, enhance operational efficiency, and maintain full compliance across musculoskeletal and orthopedic claims workflows.

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others