CPT Code 99490 – Chronic Care Management (CCM), First 20 Minutes

CPT Code 99490 Guide Summary

Quick Summary: CPT® 99490 represents chronic care management (CCM) services provided by clinical staff under the direction of a physician or other qualified health care professional. The code captures the first 20 minutes per calendar month of non–face-to-face care coordination for patients with two or more chronic conditions that place them at significant risk of death, acute exacerbation, or functional decline. Because CPT 99490 is time-based, cumulative, and staff-performed, it is closely monitored by Medicare and commercial payers for documentation sufficiency, duplication, and improper bundling.

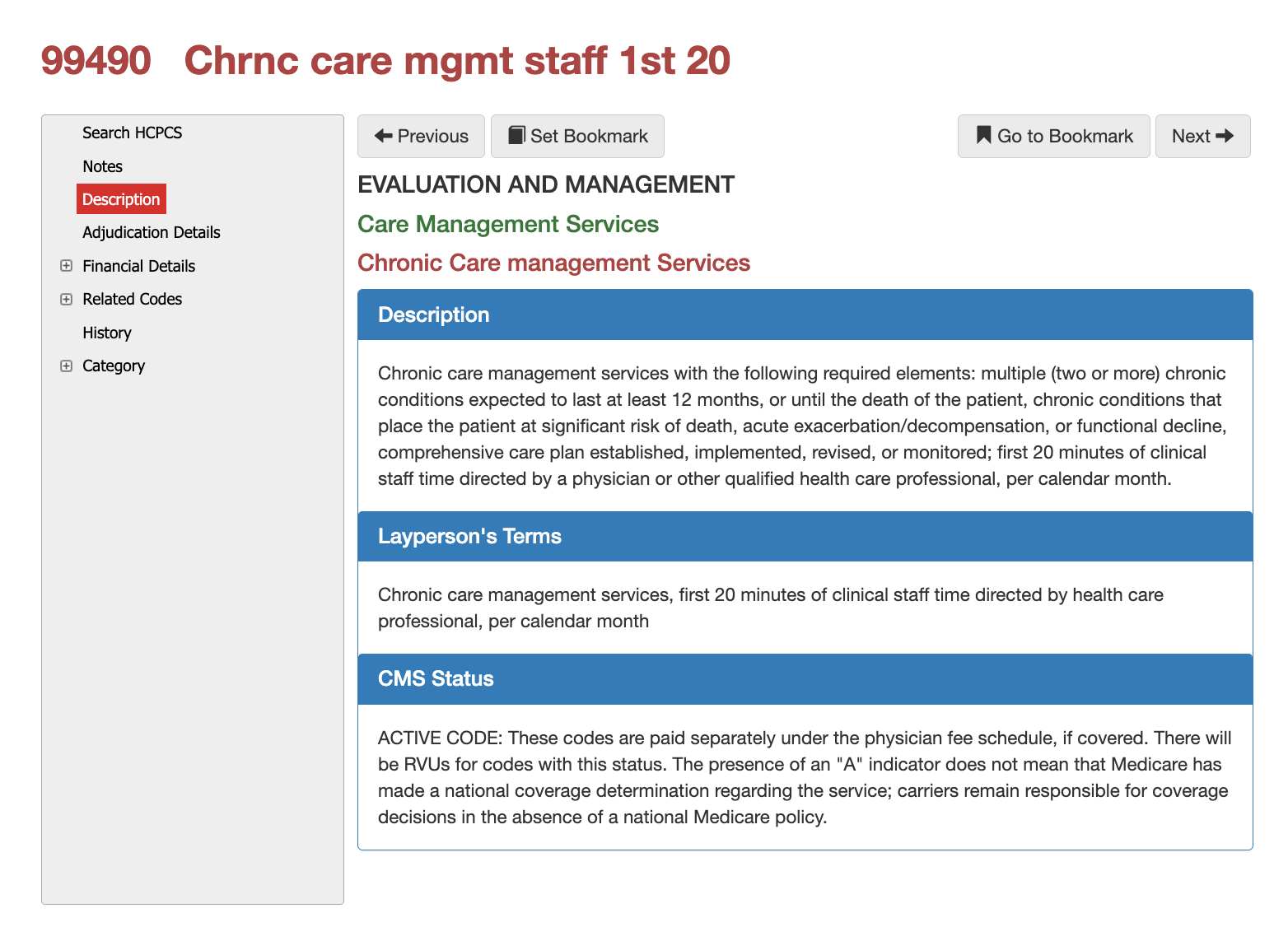

Formal CMS Description for 99490

Chronic care management services with the following required elements:

Multiple (two or more) chronic conditions expected to last at least 12 months or until the death of the patient

Conditions that place the patient at significant risk of death, acute exacerbation/decompensation, or functional decline

Comprehensive care plan established, implemented, revised, or monitored

First 20 minutes of clinical staff time, directed by a physician or other qualified healthcare professional, per calendar month

Layperson Description for 99490

CPT 99490 covers the monthly coordination of care for patients with long-term health conditions. It includes time spent by nurses or clinical staff—under a provider’s supervision—reviewing records, managing medications, coordinating with other providers, updating care plans, and communicating with the patient outside of regular office visits.

Who, What, When for CPT Code 99490

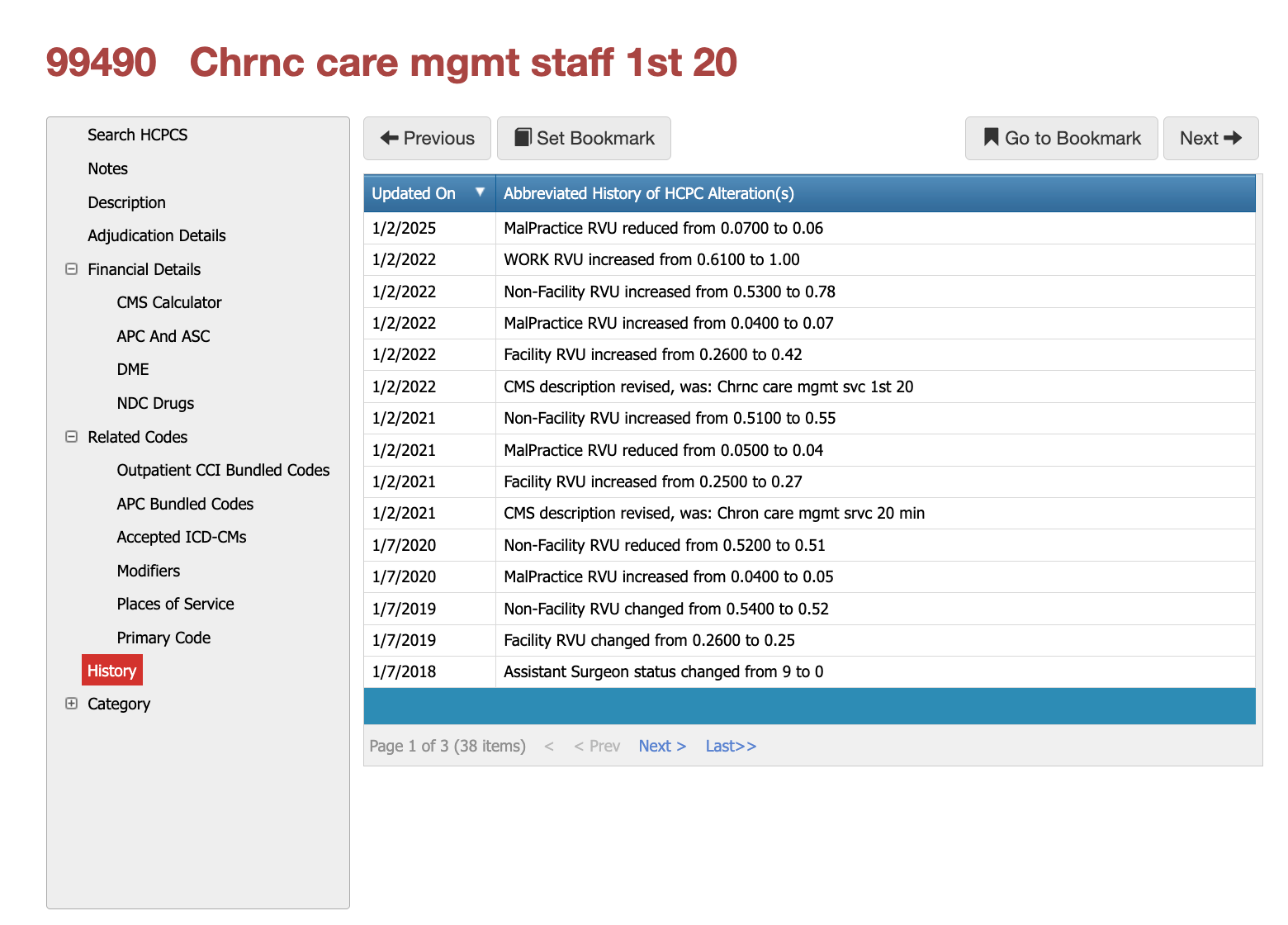

History of CPT Code 99490

Since its introduction, CPT 99490 has undergone multiple revisions affecting RVU values, practice expense allocation, and CMS descriptor language. These changes reflect CMS efforts to refine valuation, reduce overlap with other care-management services, and align payment with evolving care-coordination models. Historical revisions are often referenced during audits to evaluate billing patterns over time.

Who bills for CPT Code 99490?

CPT 99490 is billed by physicians and qualified health care professionals who assume overall responsibility for chronic care management, even though the service time itself is furnished by clinical staff. The billing provider must oversee the care plan and ensure all CCM requirements are met. Claims submitted without evidence of physician direction or staff involvement are routinely denied during audit.

Sources: iVECoder, CMS, Virtual AuthTech

When is CPT 99490 Appropriate?

This code may be billed once per calendar month when the patient has two or more chronic conditions expected to last at least 12 months or until death, and when those conditions place the patient at significant risk of deterioration in health. Time must be accumulated across the month and cannot overlap with other CCM or transitional care services. Only one provider may bill CPT 99490 for the same patient in the same month.

Sources: iVECoder, CMS, Virtual AuthTech

Document Multiple Diagnosis for CPT 99490

Diagnosis coding must clearly support the presence of multiple chronic conditions with ongoing management needs. Payers expect ICD-10-CM codes that demonstrate long-term disease burden, risk of exacerbation, and need for continuous coordination. Claims lacking diagnostic complexity are frequently flagged by automated edits.

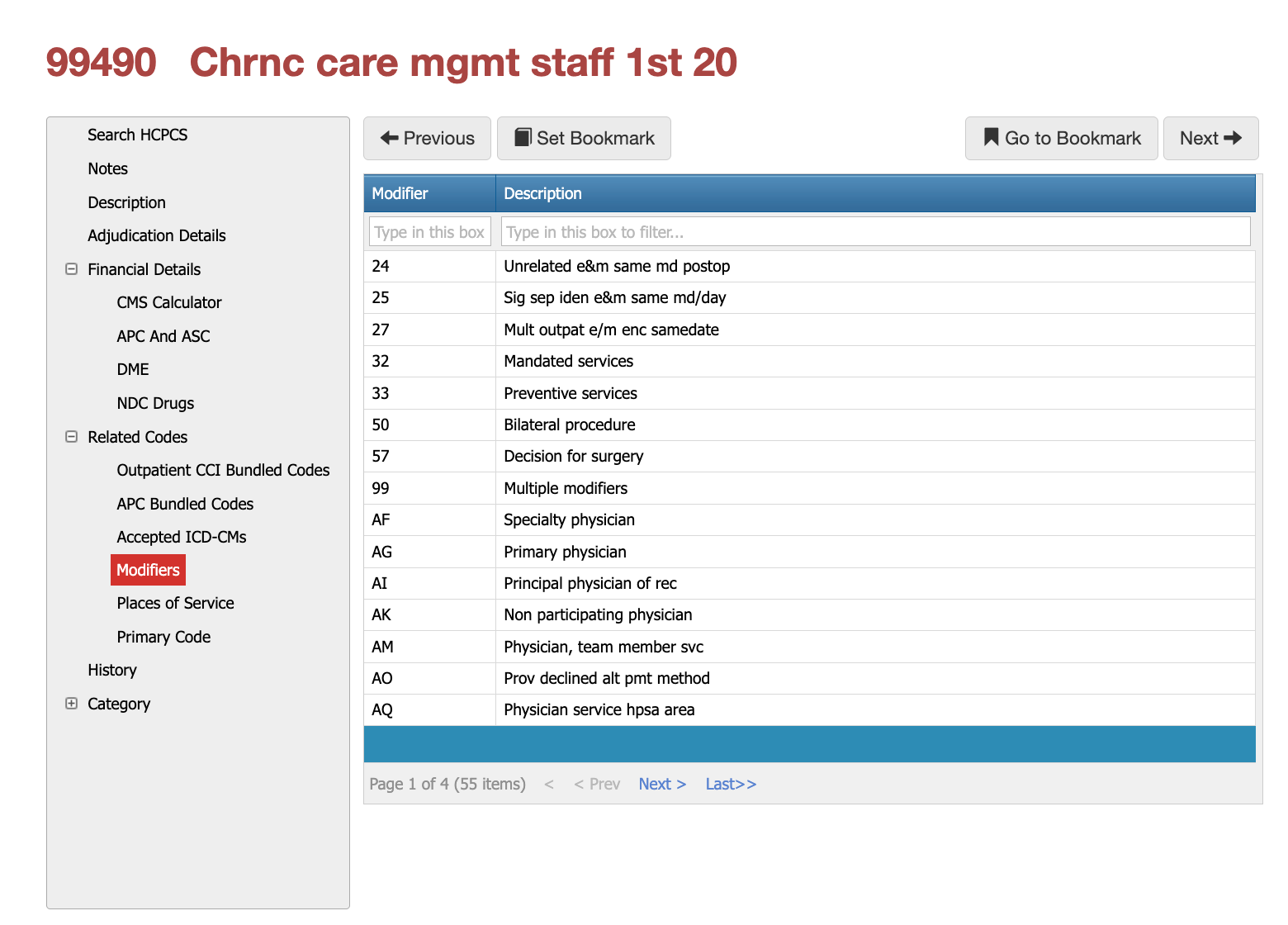

Modifiers and Places of Service for 99490

Applicable Modifiers for CPT Coder 99490

Modifier use with CPT® 99490 is uncommon and closely scrutinized because chronic care management is already a cumulative, monthly service. When modifiers are applied, payers evaluate whether the underlying diagnosis context truly supports separate payment or whether the modifier is being used to bypass CCM exclusivity rules. Diagnosis selection and clinical intent drive acceptability more than the modifier itself.

Modifier 25 Example for 99490

Modifier 25 may be appropriate when a face-to-face E/M visit occurs on the same date as chronic care management activities, but only when the visit addresses a distinct clinical issue unrelated to routine CCM oversight. Payers expect the diagnosis on the E/M line to reflect an acute or new condition, not the same chronic conditions used to justify CPT 99490.

Example:

A patient with established diagnoses of congestive heart failure and type 2 diabetes qualifies for monthly CCM under CPT 99490. During the same month, the patient presents for an in-office visit due to acute cellulitis of the lower extremity. The E/M visit is billed with Modifier 25 and linked to the cellulitis diagnosis, while CPT 99490 remains linked to the chronic cardiac and endocrine conditions. This structure demonstrates separate medical necessity and avoids CCM duplication concerns.

Modifier 25 Example for 99490

Modifier 59 is rarely appropriate with CPT 99490 because CCM is not a procedural service in the traditional sense. When used, payers expect the diagnosis to clearly demonstrate that the reported service is not part of care coordination, chronic monitoring, or disease management already captured by CCM.

Example:

A patient enrolled in CCM for chronic obstructive pulmonary disease and chronic kidney disease undergoes a distinct diagnostic procedure for a newly identified gastrointestinal bleed. If a separately reportable service is billed on the same claim, the diagnosis associated with that service must reflect the acute GI condition, not the chronic CCM diagnoses. Modifier 59 may be evaluated for procedural separation, but CCM time must remain strictly tied to the chronic diagnoses only.

Modifier FS is usually NOT applicable

Modifier FS is not typically applicable to CPT 99490 because CCM is already defined as clinical staff time under physician supervision. Attempting to apply Modifier FS to CCM claims often results in denials, especially when diagnoses overlap with other care-management or inpatient services.

Example:

If a patient with multiple chronic conditions is receiving CCM and also has a split/shared inpatient E/M visit, Modifier FS applies only to the E/M service and its associated diagnoses. CPT 99490 must remain diagnosis-linked to outpatient chronic care management and cannot share attribution with inpatient E/M services.

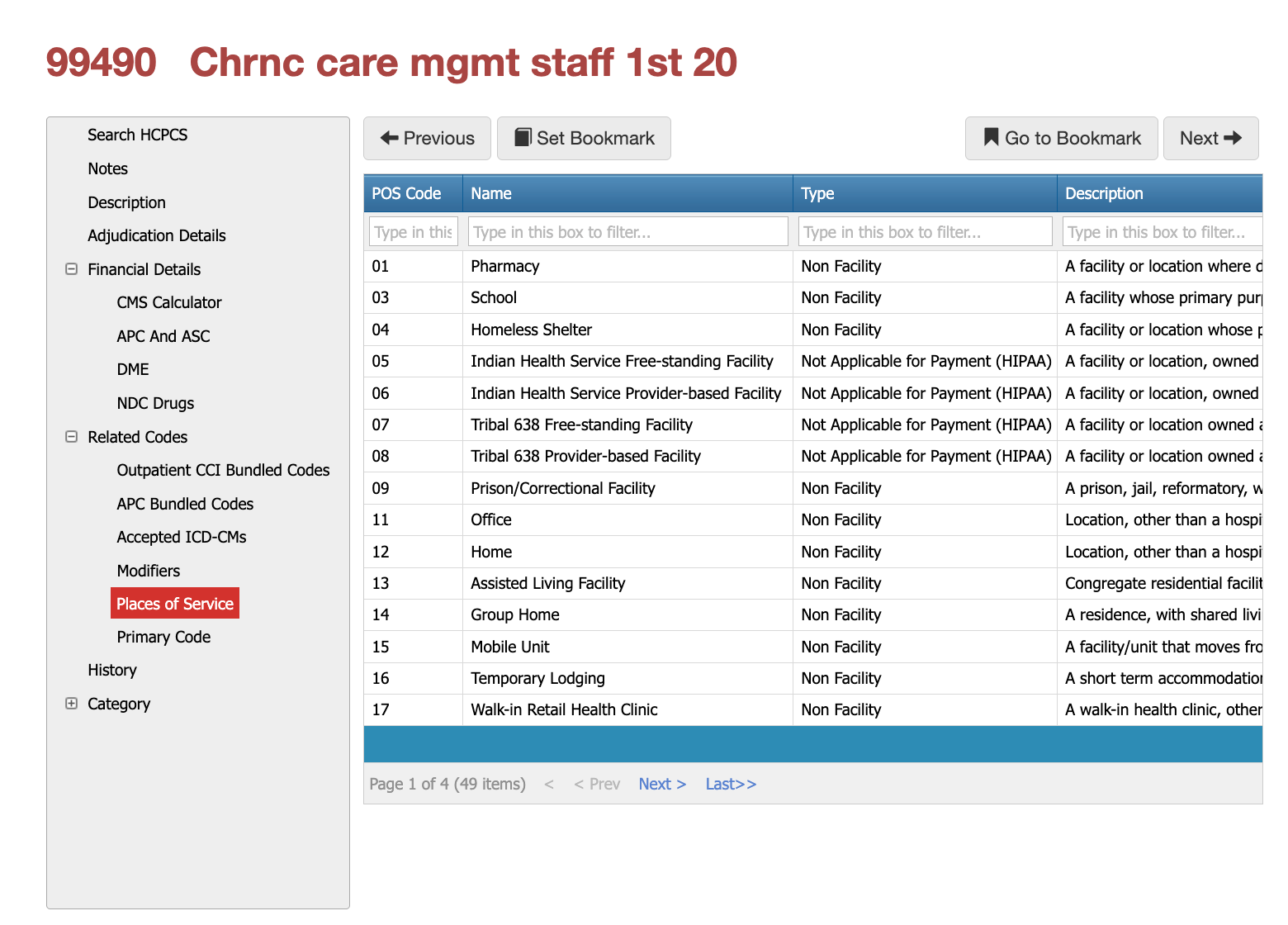

Most Commonly Used POS for 99490

CPT 99490 is primarily billed in non-facility settings, including physician offices, patient homes, assisted living facilities, and other community-based environments. Place of service must align with CCM rules and supervision requirements. Facility-based billing scenarios are subject to additional scrutiny and may result in reduced or denied payment.

Adjudication and Global Period Considerations

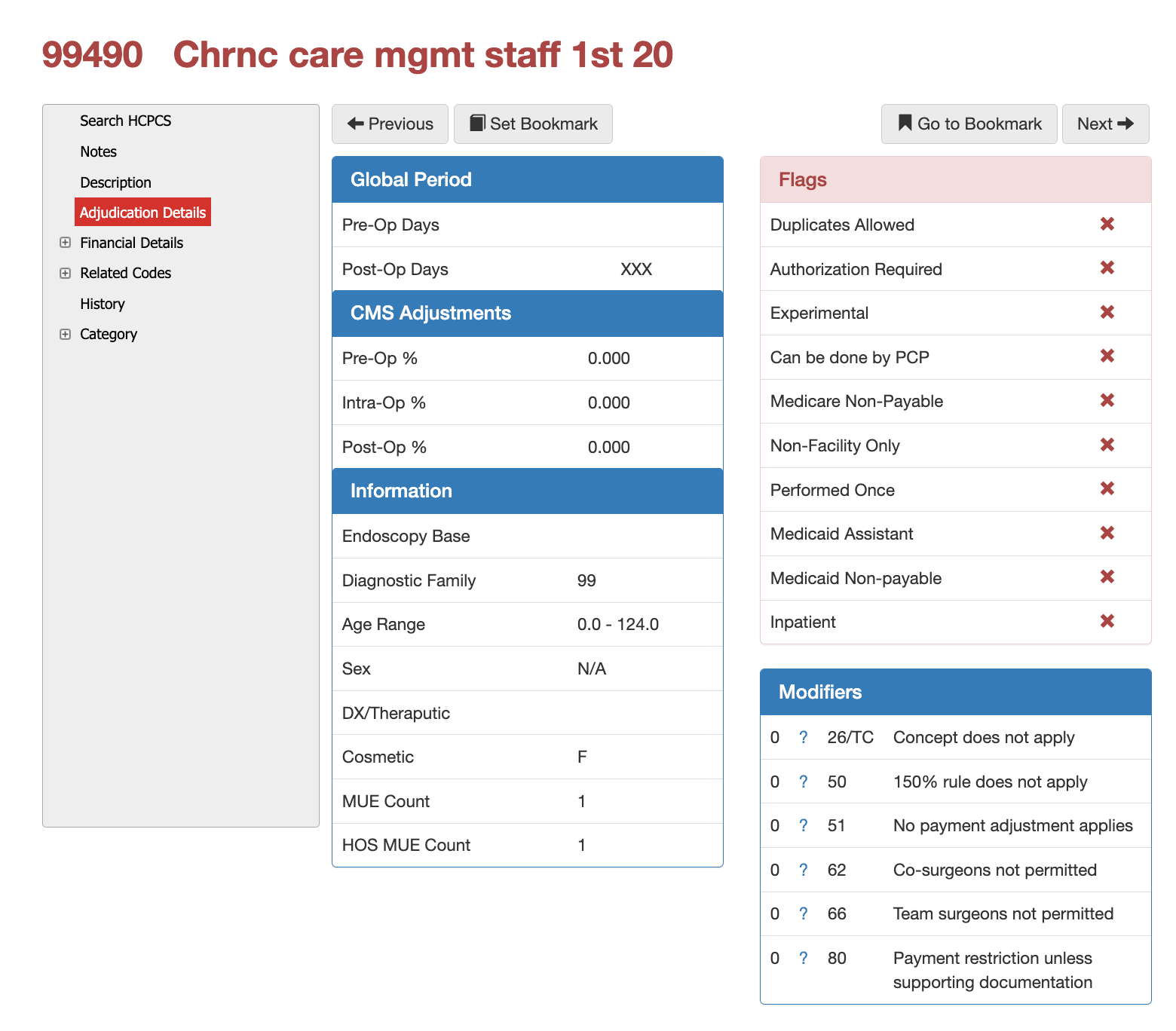

Global Periods Considerations for 99490

CPT 99490 carries no global surgical period and is not associated with pre-operative or post-operative payment percentages. The service is evaluated independently of surgical care but is subject to monthly frequency limits, MUE restrictions, and duplication checks. Payer adjudication systems evaluate overlapping care-management services aggressively due to the cumulative nature of CCM billing.

CPT Code 99490 - CCI and APC Bundling Logic

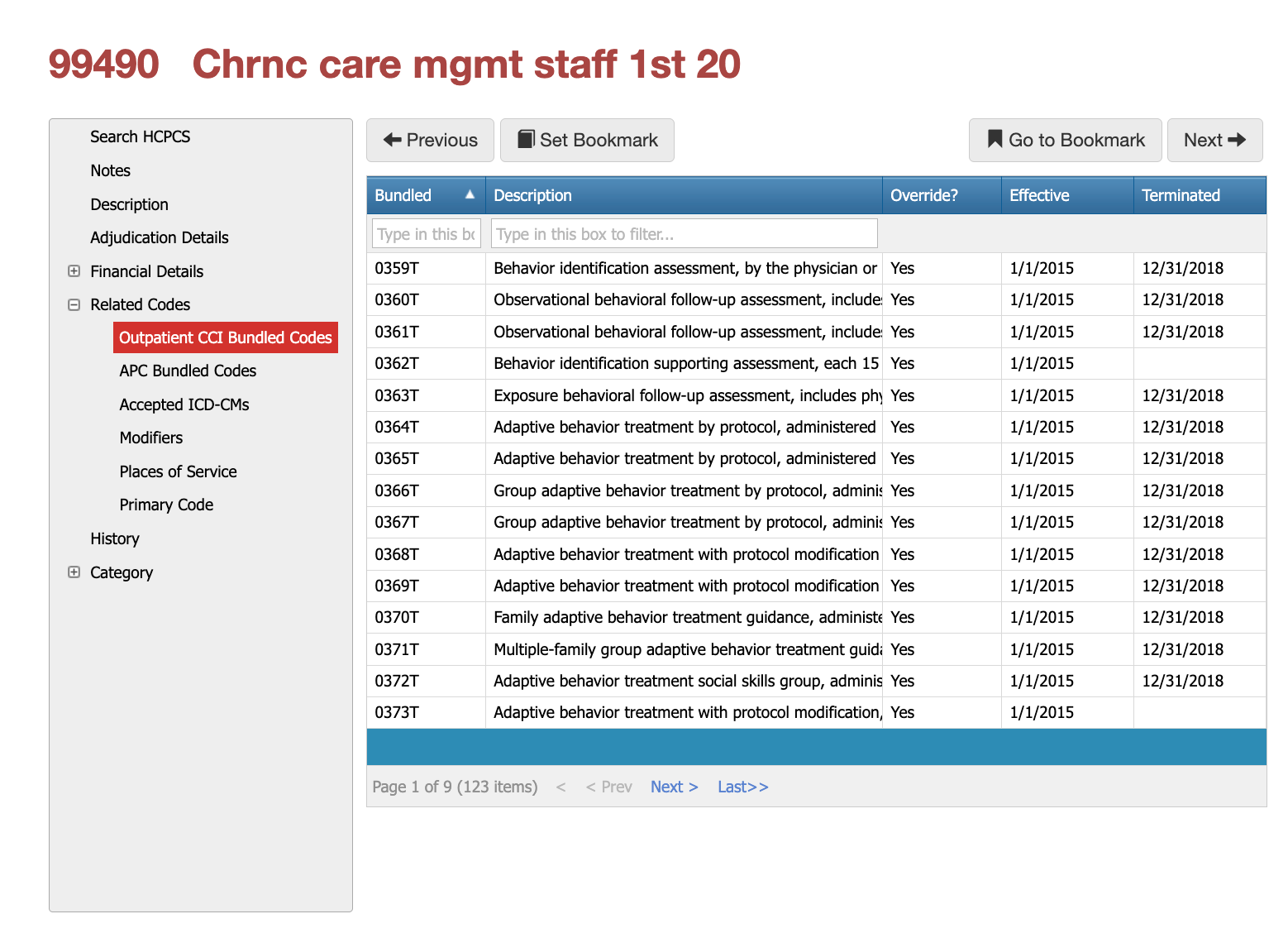

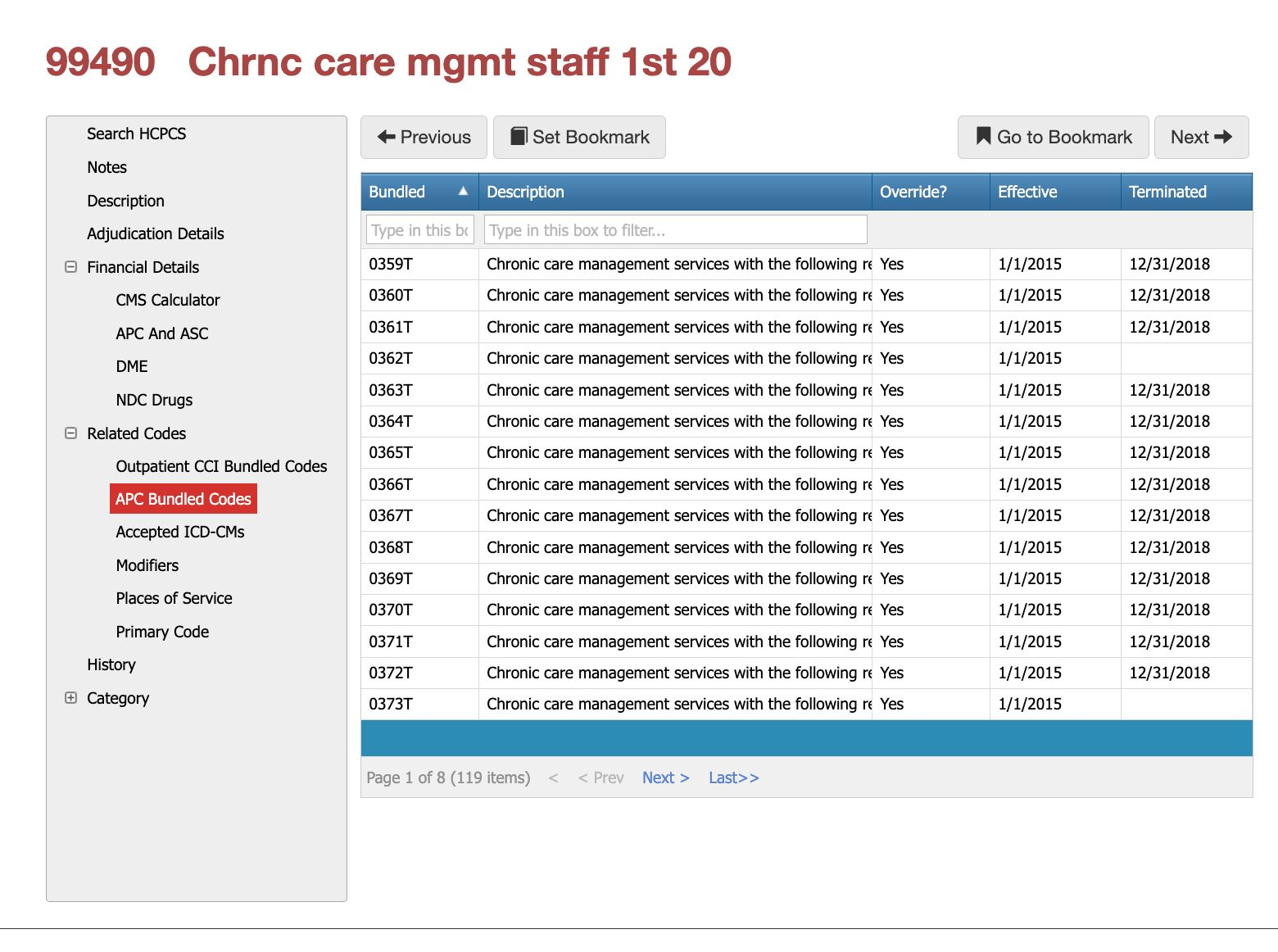

CPT 99490 is subject to extensive CCI bundling logic, particularly with other care-management and behavioral health services. Many related HCPCS and CPT codes are bundled or mutually exclusive when billed within the same calendar month. APC bundling rules further restrict separate reimbursement in facility settings. Improper unbundling is a common source of post-payment recovery.

The images below show that there are 123 possible CCI bundled codes, 119 APC bundled codes that could apply, but which bundled code applies is based on the patient's diagnosis, as well as other factors. Utilizing software like iVECoder for billing or Virtual Examiner for claims will help you quickly find the right bundled code.

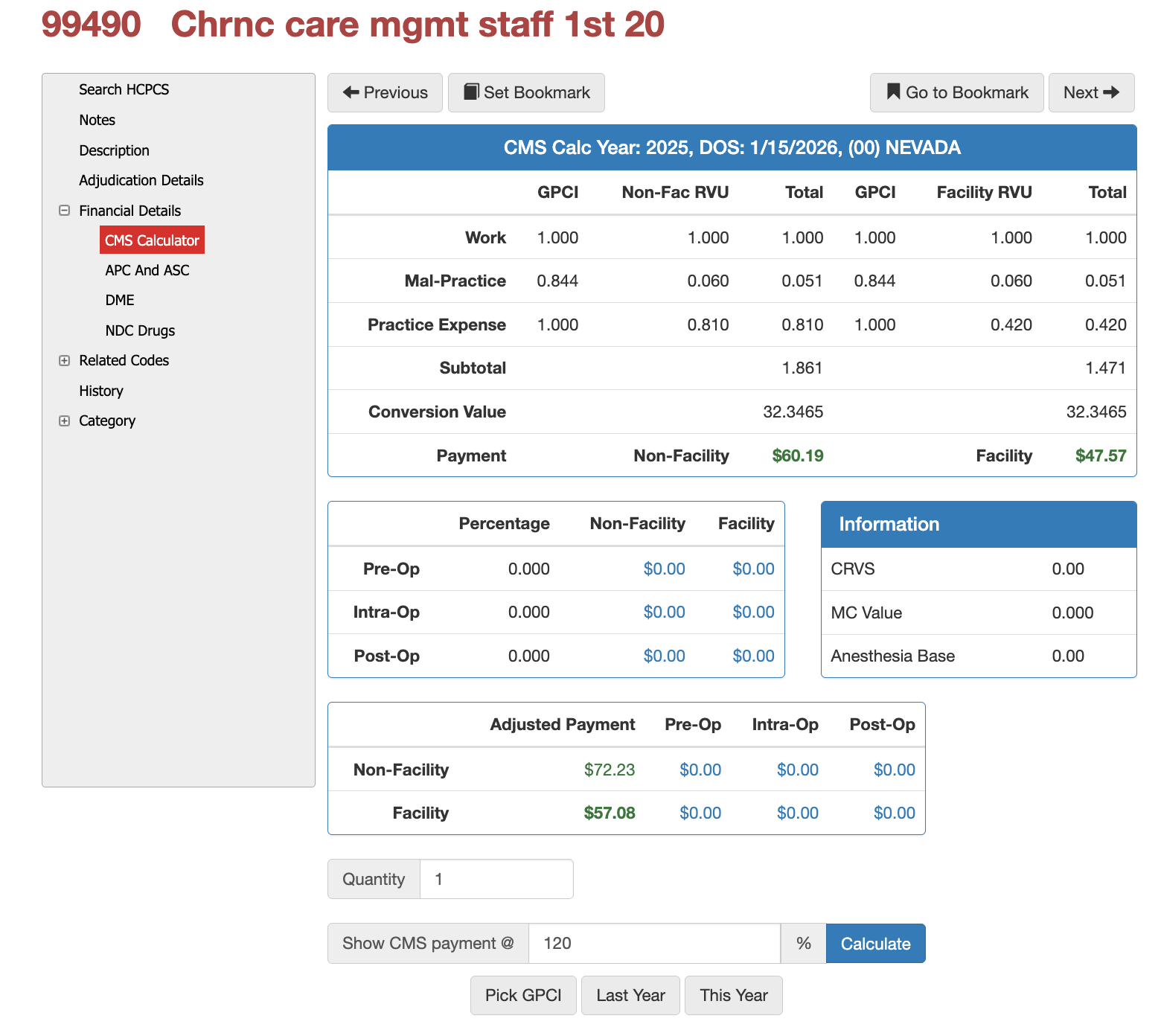

CMS Payment Rates and RVU Structure

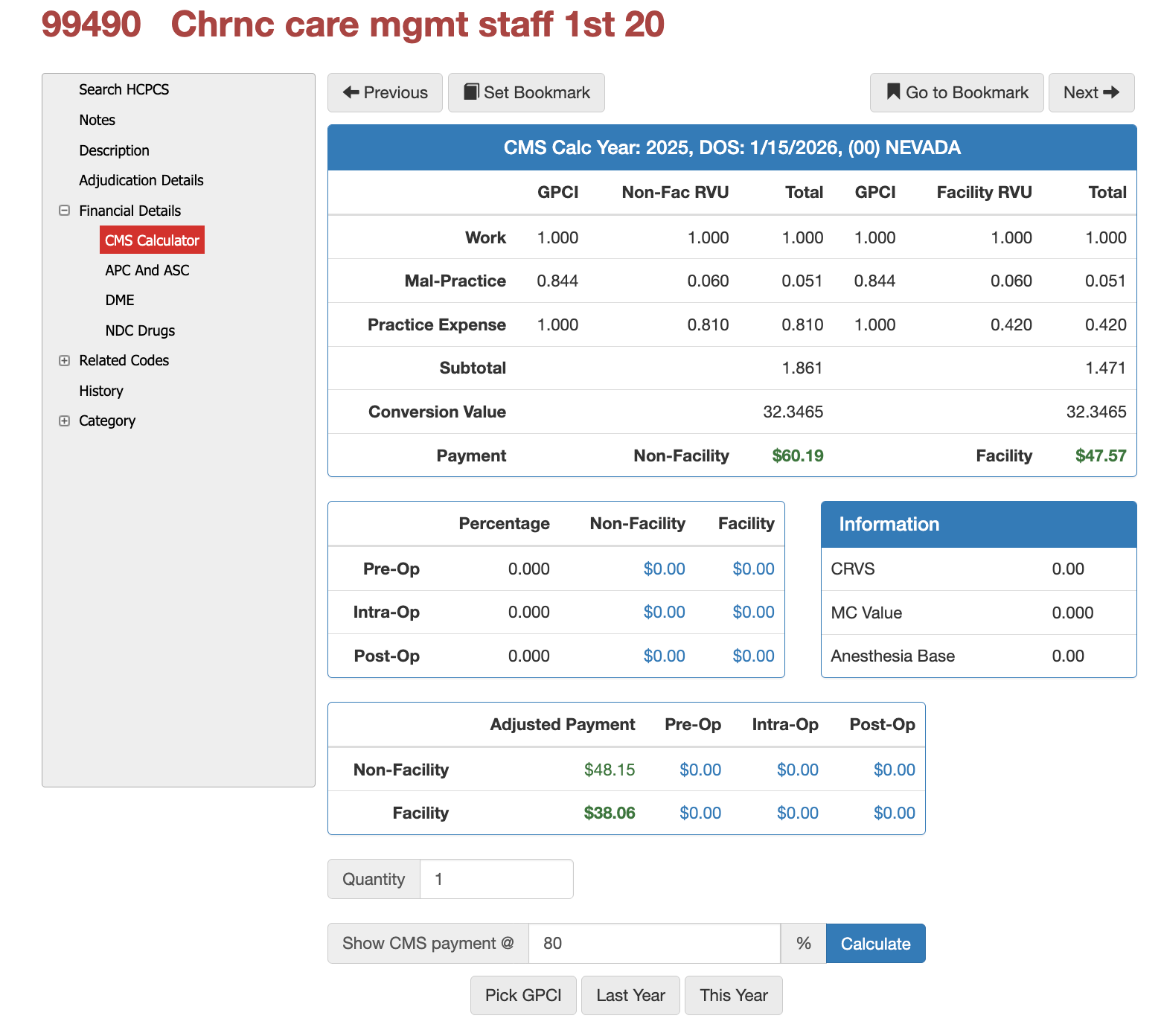

CPT 99490 carries defined work, practice expense, and malpractice RVUs that vary based on facility versus non-facility settings and geographic adjustment factors. CMS payment calculations reflect staff-based care delivery rather than direct physician time. Health plans frequently benchmark payments to Medicare rates, adjusting for contractual percentages such as 80% or 120% of CMS-allowable.

PCG Tip: See the pics below for the financial impact of contracting at 80% versus 120%. Then, when using iVECoder, you can help set acceptable pricing as a payer or re-negotiate more favorable pricing as a medical group or provider.

Common

Denial Triggers and Audit Risks for CPT Coder 99490

Claims for CPT 99490 are most frequently denied due to insufficient documentation of time, lack of evidence of a comprehensive care plan, overlapping CCM services, or billing by multiple providers in the same month. From a payer perspective, improper CCM billing is a high-visibility risk area and a common target for utilization review and recovery audits.

Diabetes Diagnosis Mismatch Denial Example

Across all modifiers, the most common denial pattern involves diagnosis overlap. When the same ICD-10-CM codes appear on both CPT 99490 and another E/M or procedural service, payers frequently determine that the work is duplicative. Modifiers do not override this logic. Claims systems and auditors rely heavily on diagnosis separation to confirm that CCM represents longitudinal care coordination rather than episodic treatment.

Example:

Billing CPT 99490 for diabetes management while also billing a separate E/M visit with the same diabetes diagnosis and no documented acute change is a frequent cause of recoupment, even when a modifier is appended. Payers interpret this as double billing for the same clinical work.

Denial Due to CCM Time Inflation and Overlapping Clinical Activity

A 74-year-old Medicare beneficiary with documented diagnoses of type 2 diabetes mellitus, hypertension, and stage 3 chronic kidney disease is enrolled in chronic care management and billed under CPT® 99490 for the month of June. The claim reports the required 20 minutes of clinical staff time and includes appropriate consent documentation.

During the same month, the patient has multiple documented touchpoints, including two brief medication refill calls, one portal message exchange regarding lab results, and a scheduled in-office E/M visit for diabetes follow-up. The CCM documentation aggregates all clinical interactions into a single time total without distinguishing which activities occurred outside of billable CCM scope or which were already captured within the separately billed E/M service.

Upon review, the payer determines that a portion of the reported CCM time overlaps with work performed during the face-to-face E/M visit and routine prescription management. The claim is denied on the basis that the documented time does not represent distinct, non-duplicative care coordination activities as required under CCM guidelines. The denial rationale cites insufficient separation between CCM activities and other reimbursed services, resulting in failure to meet the minimum time threshold once overlapping work is excluded.

From an adjudication perspective, the issue is not the absence of a modifier, but the inability to substantiate that 20 full minutes of qualifying CCM work occurred independently of other services. The payer notes that while the diagnoses support chronic care management eligibility, the documentation does not demonstrate that the reported time reflects cumulative, longitudinal coordination rather than episodic clinical interactions already reimbursed elsewhere.

Are you tired or "searching online" for CPTs?

If you’ve made it this far, you’re officially more committed than most clinicians, coders, or claims examiners—and that’s exactly why we build tools that do the heavy lifting for you. Instead of digging through long articles every time a complex CPT code shows up, iVECoder® gives both payers and providers a stand-alone scrubber that explains the rules, checks modifiers, validates documentation needs, and flags billing conflicts in seconds. And for organizations looking to go even deeper, our Virtual Examiner® (VE) claims and FWA suite identifies overpayments, detects fraud and waste patterns, strengthens compliance, and saves teams hundreds of hours each year. When you're ready to stop reading CPT blogs and start automating coding accuracy and payment integrity, we’re here to help.

Click the button right below for IVECoder or complete the form for a FREE Payer Audit.

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

Free Payer Claims Audit

Complete the form, and we'll contact you to schedule an introductory meeting and discuss our FREE 3-year claims audit to identify areas for cost containment and compliance.

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others