What is a MSO?

Quick Definition of Managed Service Organization (MSO):

Many IPAs choose to partner with an MSO (Management Services Organization). MSOs provide the non-clinical administrative and financial expertise that some doctors and medical groups don’t have but surely need to ensure solvency and business growth. Here are some of the most common support services they provide within themself or facilitate a list of vendors for their medical groups, providers, and IPAs (link):

- Medical Billing

- Accounts Payable, Accounts Receivable

- Complete Revenue Cycle Management Program (RCM); Billing, AP, AR

- Payer Negotiations

- Credentialing

- IT Support

- Recruitment of Non-Clinical staff

- HR Support

- Property Leasing or Property Acquisitions

- Equipment Rental or Acquisitions

- Drug and DME Supply Chain Services

What's Different about an MSO?

An MSO can be owned by anyone, unlike an IPA, Medical Practice, or Pharmacy, which must be owned by a Licensed Provider (MD, DO, NP, PA, or PharmD). The role of the MSO is to assume the liability for coordinating support for Providers and IPAs, allowing them to focus more on patient outcomes and on improving the efficiency of internal clinical operations. MSOs may also be formed outside the states of their clients, unlike an IPA.

California Example of MSOs in Action

Why is it important to the healthcare system that providers accept financial risk and develop integrated, coordinated patient care models? Recent data developed under a grant from the California Healthcare Foundation and presented by the Integrated Healthcare Association shows that on a regional basis, such provider delivery models out-perform more traditional networks of “fragmented” providers paid on a purely fee-for-service basis. The data, available at www.iha.org. indicates that these risk-bearing providers operating in an HMO coverage model provide better quality care at a lower per-capita cost, saving the California healthcare system $3 billion annually.

California MSOs have provided actionable data analytics to enable physicians to identify at-risk patients so that they can engage and intervene to improve a patient’s health status. They have developed support services that include additional care coordination staff, patient scheduling and outreach, provider education, compliance expertise and staffing to handle audits and reporting requirements, and adequate legal and contracting support. We will explore these functions further in this white-paper. An important point to remember is that MSOs provide localized capabilities and service – because effective health care is local in nature.

Smaller, predominantly Medi-Cal-oriented physician organizations would not be able to sustain their practices. These physician practices were not provided funding to improve their care delivery infrastructure under the Hitech Act, the ACA, or in any California innovation waiver. They cannot afford to purchase electronic infrastructure, let alone have the time to properly use it for actionable data analytics that can help to improve their care delivery. They cannot cope with the administrative burdens that arise from contracting with several health plans. There would be further consolidation across the market of physicians, less organizations for health plans to contract with to form their networks, and there would be less physicians interested in seeing Medi-Cal patients.

Contracting with an MSO

What type of provider groups seek management services from MSOs? Small and medium-sized capitated-delegated physician groups seek management services from MSOs for their Medi-Cal business, as well as other payer lines, like Medicare and commercial health plan HMO or PPO. Federally Qualified Health Centers also contract with MSOS.

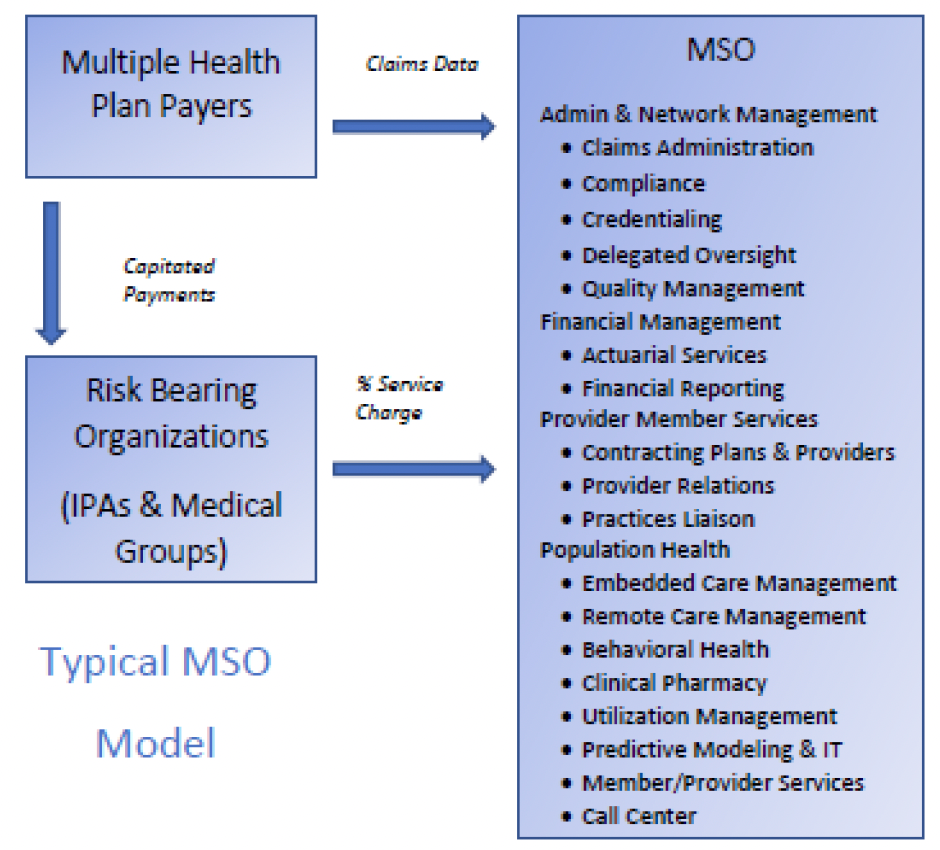

The typical MSO arrangement is structured such that a health plan payer contracts with the IPA or Medical Group to pay capitation based on the number of lives cared for by the group or clinic. The IPA or Medical Group contracts separately with the MSO for a small percentage fee, based on the number of lives in the group, or a flat service fee.

The MSO coordinates data exchange with the client-contracted health plans, including claims & encounter data reporting, and performance reporting.

Common Services and Functions of an MSO

Consumer Experience: MSOs can provide local assistance to physician practices in coordinating patient scheduling. This accelerates the patient’s access to care and focuses on warm handoffs between providers that improve the patient experience. They aid patient outreach focused on cultural & linguistic needs, targeting improved understanding, engagement & adherence. MSOs can provide care coordination staff who monitor admissions and discharges, following up directly with patients, explaining medications, setting follow-up appointments, and checking in on patient progress. These services deliver the high-touch that is necessary to achieve superior outcomes for patients who are chronically ill, elderly, or have difficulty navigating the system on their own.

Utilization Management: MSOs can manage the job of determining patient eligibility and enrollment, a frequent task that involves data exchange between the payer plan and provider organization in a managed care system. When a physician organization contracts with several health plans, there is a constant exchange of eligibility files between the plan and group that requires experienced administrative staff and IT support. Denials are sometimes necessary, and usually run at a rate of no more than 4 percent of all authorizations that are handled on a monthly basis. Denials of services require prompt attention that necessitates adequate staffing. MSOs also maintain a staff of their own medical officers and nurses to provide the necessary clinical oversight during this process. Accurate, auditable records of these activities must be maintained and frequently provided to plan and regulatory reviewers. The scale of the MSO provides that level of competent service to smaller physician organizations.

Clinical Information: Capitated-delegated physician organizations must report encounter and claims data to each of their contracted health plans. This is usually facilitated through data exchange with an intermediary like Transunion. MSOs maintain experienced staff and up-to-date claims processing infrastructure that smaller physician organizations cannot afford to maintain. MSOs also provide services to help provider organizations educate their physicians and staff on proper reporting and assist with data error correction to achieve higher accuracy. Most physicians in managed care systems must also report on over 230 separate quality measures to various payers like CMS, health plans, Medi-Cal and Covered California. This is a daunting task to capture and translate clinical data obtained at the provider level and transmit it in the appropriate form and timetables required. Moreover, the real value of a good MSO is its ability to make clinical data actionable for its clients, for use in population health management, network management, and risk-assessment.

Administrative & Risk Management: Provider organizations are formed under California law to require only licensed clinical professionals within the group. Lay people are not permitted to own medical groups or IPAs. Many smaller physician organizations are organized as shareholder medical groups made up of practicing physicians. MSOs have the scale to hire competent, experienced management and staff with financial, actuarial and IT skills. The MSO provides the right capability to assess risk-based, capitated contracts with payers. Risk-bearing organizations (RBOs) must also provide financial solvency reporting to the DMHC on a quarterly basis and are sometimes subject to corrective-action plan compliance for both financial and clinical processes. MSOs provide the help necessary for sustainable compliance. They also provide legal and operational support to keep the practice running.

Population Health Management:

The successful management of large patient populations requires the collection of accurate patient data and its comparison to clinical data, social determinants factors, and physician performance data. There are many sources of information available to physicians but there is little time and capability to integrate and analyze that information to achieve better patient care and outcomes. MSOs can provide the IT systems to identify sub-groups of patients within an overall population, like obese diabetics, or seniors with three-or-more co-morbid conditions. They can analyze access, outcomes, and determine best practices that can be communicated to the treating physician, resulting in improved care and patient experience. Many MSOs now use predictive analytics to determine at-risk patient sub-populations, so that clinicians and care coordinators may intervene to avoid a patient becoming chronic, or to improve their medication adherence, and better coordinate their care. This kind of information empowers physician organizations to develop patient outreach strategies and to better manage the daily workflow of seeing patients and ensuring that they receive the preventive care needed. MSOs can now help physician practices leverage their own data to enable real-time information dashboards. These systems allow physicians to see their patient population at a glance and determine which preventive measures are needed based on the individual patient’s risk scoring and medical history.

Clinical Integration & Physician Alignment: MSOs help physician groups acquire and maintain the various doctors necessary to provide a complete spectrum of care. There is a constant changing of clinicians and staff, necessitating recruitment, training and development of various professionals. There must be administrative organization to keep clinicians updated on best practices, legal requirements, new standards and techniques. MSOs can provide the staffing needed for a group to meet the network size and capacity requirements to maintain health plan network contracts, meet quality standards, and expand their operational area. MSOs can also provide the management expertise to develop a successful physician culture within the organization, which promotes tighter alignment of purpose and goals within the organization.

Developing a Provider Office Support Team: The MSO formed a team of administrative and clinical professional to assist the client physician organization in meeting requirements such as HEDIS quality reporting and other Quality measurement programs. The team identified a better workflow process for the client organization, so they did not feel overwhelmed by all the requirements in a managed care system. The POS Team even assists offices with understanding how to better use EMR systems to help with their workflow. A team schedules provider education meetings and one-on-one’s so providers can better understand guidelines and criteria such as those from health plans, Milliman and others. As the California Medi-Cal system moves toward the implementation of risk adjustment factors, the Provider Office Support Team model will help client organizations understand how to meet the new requirements.

A Dedicated Customer Service Team: The MSO forms a team that is assigned to the specific client organization. Many times, it is cultural/linguistic specific to enable better patient experience and outcomes. The team and client bond over time and develop a working relationship that tackles a variety of performance improvement and compliance issues as they arise.

Case Manager Support: Where smaller physician groups cannot afford to hire care coordinators for the Medi-Cal population, the MSO has the right scale to do so and provide that service to its client groups. Care coordinators are frequently cultural/linguistic based. Some are based in the area of transitions of care from acute facility to a lower level of care, making sure any needed supplies and equipment are available. They are also very effective to deliver medication reconciliation with a recently discharged hospital patient in order to avoid readmissions. Other case managers are assigned to follow any identified members at high risk for being admitted to hospital or with deterioration of health status without this service. This includes the subpopulation of patients with multiple, chronic co-morbidities. Members are identified through many different methods, including contact from physicians, care givers and family, claims data, lab data, UM data and predictive analytics.

Hot-Spotter Clinic Models: MSOs can and have developed special clinics for their client physician organizations that enable them to aggregate resources in order to deliver highly integrated social determinant-related services along with medical care. A single medical group may not have enough high-risk patients to support such a high-touch clinic model. These clinics have been highly successful and have saved millions of dollars in health care costs and vastly improved the lives of patients who would have otherwise slipped through the cracks of our healthcare system.

Problem with the Current MSO Structure and Clinic Models:

Not all organizations are equivalent in their performance, competency, and value. There have been unfortunate, somewhat appalling instances of non-compliance in the past two years that prompted a serious examination of managed care structures in California Medi-Cal. Because the California delegated model is not directly regulated, the increasing need for delegation oversight is straining the system. When a single organization contracts with multiple payers, often as many as 10 health plans, each IPA or medical group is subjected to at least 10 annual audits by their contracted plans. If the group participates in Medi-Cal and Medicare Advantage, the number of audits increases due to the specific requirements of those programs. In addition, regulators schedule routine periodic audits of RBOs on a three-year cycle. For an independent MSO with several clients, the number of audits is increasing into the hundreds. MSOs are hiring and training compliance staff as quickly as possible. While Medicare Advantage audit protocols are well-known and standardized, newer approaches in Medi-Cal are not. Audit protocols, content and format change constantly. In this environment, compliance is very challenging. APG has committed to assisting our members and their MSOs by working with various consultants and health plans to develop and vet a model structure for Medi-Cal compliance competency.

As APG developed the Standards of Excellence Program in the mid-2000s as a best-practices guide to aspiring delegated model groups to develop the “systemness” necessary to coordinate patient care, we are developing this new program to raise the level of compliance competency across the spectrum of organizations that operate in California. The “checklist” provides the suggested best practice elements to demonstrate an adequate level of staffing, experience, and organizational integrity to function well in Medi-Cal. See Appendix, Item A, Code of Conduct and Audit Compliance Capabilities for APG Members. On the other hand, regulators need to understand that due process, and fairness need to be an integral part of their enforcement activities and protection of the public. When risk-bearing organizations are audited, there should always be provision made for the organization to present its side of the story.

Summary of What and MSO is and Does

There are significant barriers to entry into the market for providers willing to become risk bearing organizations, and there has always been a strong contingent of physicians across the nation that oppose risk-based payment and managed care. Ultimately, physicians do not have to accept financial risk, and many would prefer to continue under a fee-for-service system. But study after study shows that when physicians accept financial risk for the outcome of their patient population they perform better and deliver value to the healthcare system. This is no doubt why Medicare has moved away from pure fee-for-service payment to the MACRA model of value-based payment.

But It is becoming increasingly difficult for providers to accept risk in this market environment, ironically at just the point in time when risk-bearing models are becoming nationally recognized as “the future” of American healthcare. Not because they can’t manage the financial risk, but because they can’t keep up with the regulatory environment under which they must operate as a risk-bearing organization. Independent MSOs provide the necessary administrative infrastructure for new organizations to enter the market, so that they can function in a compliant manner and focus on the performance of their physicians.

Subscribe

Only get notifications when a new article has been published

Contact Us

We will get back to you as soon as possible.

Please try again later.

Free Payer Claims Audit

Complete the form, and we'll contact you to schedule an introductory meeting and discuss our FREE 3-year claims audit to identify areas for cost containment and compliance.

Contact Us

We will get back to you as soon as possible.

Please try again later.

About PCG

For over 30 years, PCG Software Inc. has been a leader in AI-powered medical coding solutions, helping Health Plans, MSOs, IPAs, TPAs, and Health Systems save millions annually by reducing costs, fraud, waste, abuse, and improving claims and compliance department efficiencies. Our innovative software solutions include Virtual Examiner® for Payers, VEWS™ for Payers and Billing Software integrations, and iVECoder® for clinics.

Click to share with others